Personal Finance

This channel is where we explore the holistic health of your financial house. Helpful, accurate articles include topics on credit, debt management, financial planning, real estate and taxes.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

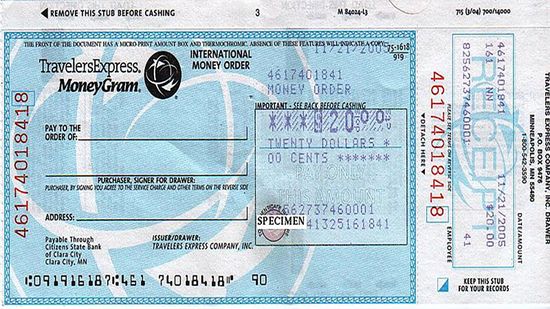

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More / Page 7

Considering the mental gymnastics some of us get into when it comes to write-offs, filing our taxes could qualify as an Olympic sport. Fortunately, the IRS offers quite a few common -- and even convenient -- deductions to help save us the trouble.

Residual - or passive - income is the kind of money generated while you're busy doing other things. Find out what passive income is and how you're supposed to pay taxes on it.

Figuring out what qualifies as a work-related travel expense can be tricky when you're in a war zone. What other challenges do active duty military personnel face at filing time?

By Julia Layton

Advertisement

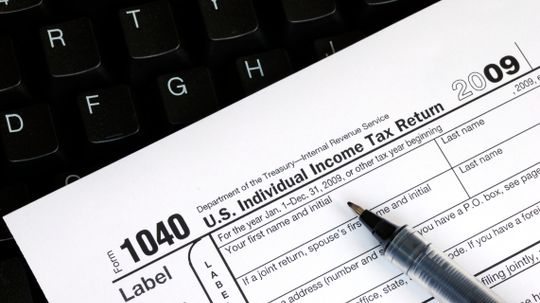

Not only U.S. citizens and legal residents are required to file federal income tax forms. Nonresident aliens have to do so as well. These have their own special exemptions.

By Dave Roos

Do you suspect someone of cheating on their taxes? You can report it to the IRS and perhaps even receive a reward. But just be sure you know what you're talking about - and be prepared to wait.

Just landed your first "real job" with a W-2 form and a health plan? If so, you might be confused about what to do at tax time. Here's a beginner's guide to satisfying the tax man.

By Chris Opfer

Whether you call it an estate tax or a death tax likely depends on your point of view: Is it a tax that benefits society or penalizes the wealthy? Whatever your opinion, learn more about the evolution of this controversial tax.

By Jane McGrath

Advertisement

A lot of factors influence just how much it costs to adopt a child. If you're thinking about adopting, here's an idea of what to expect (and why).

After decades spent in service of your country, your military pension is a well-deserved benefit. It's also income, and therefore subject to being taxed.

By Debra Ronca

Don't spend all the money you received in a settlement just yet; you probably have to pay taxes on it.

By Debra Ronca

The history of the landmark U.S. Affordable Care Act is still being written as you read this, but the larger issue of health care reform has been riling up people for decades. Ready to hit some highlights?

Advertisement

A pension is an employer-provided benefit that supplies income when you retire. When and how it's taxed, though, has a lot to do with how you paid into the pension.

By Debra Ronca

Losing a spouse can provide financial, as well as emotional, challenges, but if he or she was getting Social Security benefits, that money may keep coming to you.

By Debra Ronca

Many creative people earn money over time in the form of royalties. Of course that still counts as income, so the IRS expects money over that time, too.

By Debra Ronca

The IRS doesn't get a lot of love from American taxpayers, but it's hardly the cruel thief we make it out to be. Thanks, tax exemptions!

By Dave Roos

Advertisement

Tax credits can reduce the amount of your income tax bill and save you serious money. Learn all about how tax credits work, along with some of the most popular available credits.

Heard of a little something called the Affordable Care Act? If you're a U.S. citizen, it means that you're required to have health care coverage. But like every rule, this one has exceptions - or rather exemptions.

Unless you have an MBA in finance, trying to decipher how education is funded in the U.S. could leave you reaching for a nice glass of wine. We'll break it down so you can understand it even without the help of a chardonnay.

By Alia Hoyt

When you're doing your taxes, it's nice to see all the deductions you can take to lower your tax bill. But is it worth the work to list everything instead of taking the standard deduction?

By Dave Roos

Advertisement

You've always filed your taxes the old-fashioned way - through the mail - but you're giving serious thought to joining the 21st century and e-filing your tax return. Will this new way of filing prove to be the better way?

Being an independent contractor isn't all about sleeping in and working in your pj's. When you're your own boss, you have to pay your own taxes. It can be a tricky dance, but one worth learning if, like most of us, you enjoy saving money.

Depreciation and amortization: The words don't exactly roll off the tongue, do they? But whatever they might lack in linguistic finesse they make up for in tax savings -- often over the course of several years!

Divorce and co-parenting probably weren't part of the plan, but as they say, your child's well-being doesn't have a price tag - though all of that food and clothing does. If you're making child support payments, it's good to know your tax rights.

Advertisement

You're a teacher. You're used to going above and beyond for your students - often without reward or recognition. But a little tax relief might be nice, especially if you've been paying for classroom supplies out of your own pocket.

Come tax time, we're all looking to write off or deduct whatever we can to save money. Many of us would write off our own mothers if we had to - and with the dependency exemption, perhaps you can.