Financial Planning

Saving for college, investing in the stock market, online trading, mutual funds for many, these topics are overwhelming. No worries. We'll give you accurate, easy-to-understand information in the Financial Planning section.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

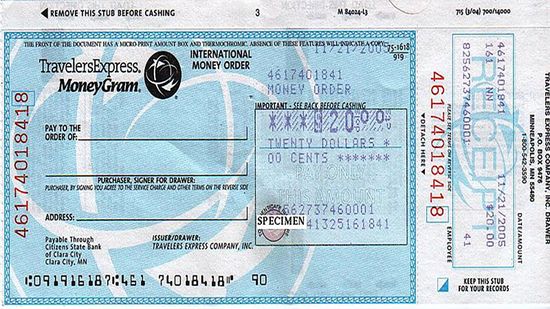

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

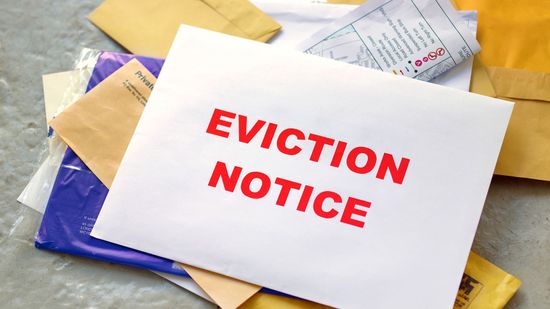

How to Avoid Being Evicted From Your Home

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More

As of 2024, the number of millionaires in the U.S. was around 23.8 million. That means roughly 1 in 15 people in the U.S. has a net worth of at least seven figures. This number includes not just tycoons but also people who have slowly built wealth through investing, homeownership, and disciplined saving.

If money was no problem, how much would you spend on a car, painting or house? We've got the items with the biggest price tags here.

The Bureau of Labor Statistics report that showed a 9.1 percent inflation rate for June has many people concerned. Here are some smart money moves to make in inflationary times.

By Dave Roos

Advertisement

A lot of people don't like to think about death, which is why many estates go unplanned. But if someone dies without a will, their survivors may end up in a long expensive fight in probate court.

By Alia Hoyt

Not all investment professionals are fiduciaries - we've got four questions that smart investors need to ask a financial adviser before putting him or her in charge of their investments.

By Dave Roos

"How low will my new interest rate be?" is not the only question to ask before you refinance your mortgage. Here are five others you should think about.

By Alia Hoyt

So you have homeowners insurance, but do you know exactly what you will need in order to file a claim when the time comes?

Advertisement

The annual cost of homeowners insurance can vary by hundreds of dollars and depend on many different factors. How can you save money on this necessary expense?

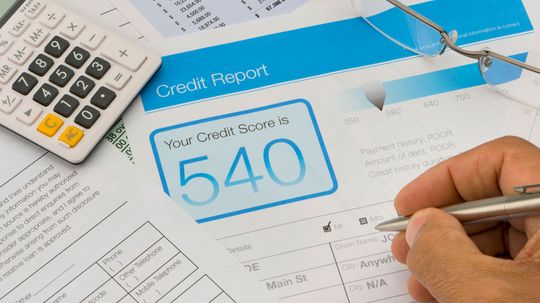

You'd like to take advantage of the low interest rates out there to refinance your mortgage, but your credit is less than stellar. Is it worth even trying to refinance?

By Alia Hoyt

Homeowners insurance generally is required only if you have a mortgage on your home. But even when your home is paid off, you'd be wise to maintain coverage.

Need some extra cash to take care of some debts? You could tap into your home equity through a cash-out mortgage refinance. But what are the pros and cons?

By Alia Hoyt

Advertisement

Many people think the only life insurance payout option is a lump sum after the insured person dies, but there are actually many choices out there. We look at some of them.

By Dave Roos

Do you have to have a relationship with the person, or can it be any old Joe?

By Dave Roos

Hurt feelings are likely to result but experts say there are times when you should leave more money to one child in your will. Just don't keep everyone in the dark about it.

By Dave Roos

The American Dream has usually meant that U.S. children will do better financially than their parents. But is this being upended by all the economic downturns of the 2000s? Can millennials overcome their poor economic start?

By Dave Roos

Advertisement

Land trusts have been used for both good and bad. They can be created for environmental conservation or to keep housing affordable. Or they can be a way to disguise the true owner of a property. Let's look at the pros and cons of land trusts.

By Dave Roos

The average American changes jobs every four years, according to the Bureau of Labor Statistics. If you're average, that means you'll have a lot of 401(k)s before you retire. Should you consolidate them into one retirement account?

By Dave Roos

After you leave a job, what do you do with your 401(k) if you're laid off or going to a job with no similar plan? You can take a transfer or rollover of your cash. We explain the difference between the two.

By Dave Roos

The unsexily named "long-term municipal bonds" are pretty important to our everyday lives. They pay for building schools or highways in our neighborhoods. And almost anyone can buy one.

Advertisement

Moving all your credit card debt to one card may see like a great deal, and sometimes it is. How do you decide whether consolidation is the best approach to tackling your unsecured debt?

Most college graduates leave school with a significant debt load, and it often takes years to pay off that education. Is it better to lump loans together? What are the pros and cons?

Few people thought the Facebook stock price would slide after its IPO, which goes to show there are many risk factors, even in a so-called sure stock. What are some of the top factors?

By Dave Roos

An emergency situation may call for legal documents that state personal preferences regarding medical treatment and other decisions. Learn what you should include in a living will in this article.

Advertisement

While it can be both volatile and unpredictable, the stock market can be a lucrative source of income for savvy investors. What exactly is the stock market, and where do you get the stocks you need to enter it?

By Marshall Brain & Dave Roos

You lost your wallet and would like to find out how to get a copy of your Social Security card. Read this article to learn how to get a copy of your Social Security card.