Personal Finance

This channel is where we explore the holistic health of your financial house. Helpful, accurate articles include topics on credit, debt management, financial planning, real estate and taxes.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

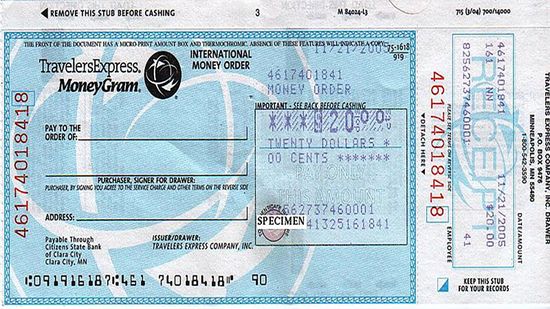

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More / Page 6

Depreciation can be a huge tax advantage for small business owners if you use the IRS depreciation tables correctly. There are nine depreciation categories and every type of property fits into one.

By Dave Roos

Paying less taxes is all about taking as many deductions and credits as you legally can. But how do you know what's out there and which ones you might qualify for?

By Alia Hoyt

One of the more controversial aspects of the Affordable Care Act is the mandate that everyone have health insurance or pay a penalty. However, certain people are exempt from this requirement. Who are they, and how do they prove their exemption?

By Dave Roos

Advertisement

Here's a handy checklist to help you gather all the documents you need to do your taxes and get the biggest refund you can!

By Alia Hoyt

Most companies offer their employees a 401(k); about half also offer a Roth 401(k) though not many employees use it. But in some cases, a Roth 401(k) might be the better option for you.

"Injured spouse status" sounds terrible, but it actually could be a good thing when it comes to paying taxes to the IRS. Learn what this tax status means for your debt and whether you qualify for relief.

When it comes to filling out tax forms, mistakes happen. It's up to you to make sure you've corrected them. That's why the IRS provides Form 1040X. Learn more about the amended tax return form.

By Jane McGrath

Advertisement

The fresh air, the open fields, the rooster crowing in the distance: Who doesn't yearn for the farmer's life? But idealized as it may be, farming is still a business -- a volatile one at that -- and farmers need all the tax breaks they can get.

Many people who benefit from the Affordable Care Act also have to do some financial juggling pay their monthly premiums. But a tax credit can help. Find out how they make the Affordable Care Act, well, affordable.

How does the federal government provide a financial incentive to businesses to hire groups who have historically found it difficult to find full-time work? Through the work opportunity tax credit.

By Susan Sherwood

Special tax credits are available to people with disabilities as well as to those who care for them. Let's explore them.

By Susan Sherwood

Advertisement

We're all looking for ways to reduce the amount of money we give to Uncle Sam. Did you know there's a way to do that and save for retirement at the same time? Find out how putting money in a (401)k can reduce your tax bill.

Your honeymoon's barely over, and it's already time to file your taxes. You heard filing jointly had great perks, but will you and your beloved still benefit since you haven't even been married a year?

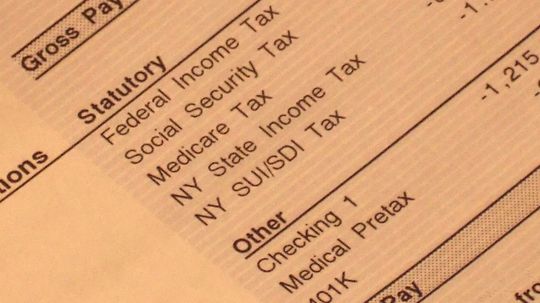

One perk of being employed (as opposed to being an independent contractor) is that your company pays half of your Federal Insurance Contributions Act tax. No clue what FICA is? It accounts for a big chunk of your federal income taxes.

You're about to tie the knot and your fiancé drops a bombshell. He owes a hefty sum in back taxes to the IRS. Now what? Will his bill become yours after you say your "I do's"?

Advertisement

Bankruptcy is difficult enough to deal with by itself. But then adding the drudgery of figuring out how it will affect your tax return can make your situation feel hopeless. But it's not. Your options depend on the form of bankruptcy you filed under.

You both pay the bills. You both keep a home. You both raise the kids. Does the IRS consider you both heads of households?

Mega Millions and the Powerball lotteries have collectively hit over $1 billion. But if you happen to win one (or both) how much will Uncle Sam want?

Private school has a number of benefits. But what about when it comes to tax day? What is the IRS doing to help ease the cost of your child's education?

Advertisement

You're certain you and your partner have to work, rather than one of you staying home with the kids. The truth is, it could make more financial sense for one of you to stay home. Let's do the numbers.

If you make money from the stock market, the IRS is interested in that - they get a cut. How do you determine what you owe them?

By Susan Sherwood

You might be tempted to pay less than you owe on taxes throughout the year and make up the difference at tax time. Unfortunately, the IRS does not agree with that tactic and may sock you with a penalty.

By Susan Sherwood

The IRS recognizes five types of business: sole proprietorship, partnership, C corporation, S corporation and limited liability company. Which one should you choose?

By Susan Sherwood

Advertisement

Knowledge of your current financial situation, and a degree of clairvoyance, goes far in determining which of your employer's retirement plans is right for you.

By Susan Sherwood

An IRS audit is treated on TV with the same dread as hearing Bigfoot in the forest. But an audit doesn't always spell doom and gloom and we'll tell you why. We can't speak for Bigfoot, though.