Now that digital payment options like credit cards, Venmo and PayPal are so common, paper checks are quickly fading into obscurity. However, there are still reasons you might need to write a check. For example, since credit card companies charge fees to businesses that use them, some businesses will pass those fees on to their customers — or won't accept credit cards for that reason. Sometimes there's a minimum charge to use a credit card and you don't meet it. A one-person business, like a babysitter or lawn mower may only take cash or checks. And a techno-phobic friend may ask you to reimburse them via check.

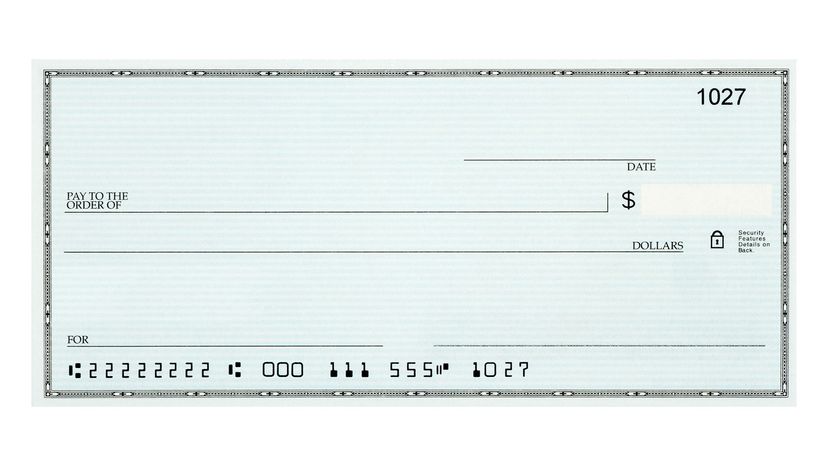

Writing a check isn't quite as fast and convenient as a credit card or smartphone app, but it's pretty straightforward. You'll just need to follow these six steps to complete a check.

Advertisement

- Date the check. This goes on the topmost line, where it says "date." Use the date that you write and sign the check. You may have heard that you can post-date a check – that is, write it for a date in the future – if your account is low on funds, with the idea that you'll replenish your account before the check clears. Usually, that's not true. The check recipient and the bank can cash the check immediately even if it's post-dated.

- On the Pay to the Order of line, write the name of the business or individual you're paying.

- In the box at the right with the $ sign, write the amount of the check using numbers. Start writing right next to the left edge of the box, that way no one can be sneaky and add an extra number in hopes of tricking the bank into giving them more money than you intended.

- In the line below "Pay to the Order of" (where it says "dollars"), write out the check amount in words, and of course, ensure that this amount matches the numbers you wrote. You can write out the cents portion just as you did the dollar amount, or write the cents as a fraction, with 100 as the denominator. (Some people draw a line or squiggle after the words to fill out the rest of the space and prevent alteration of the amount.)

- Use the memo line (in the bottom left where it says "for") as a reminder of what the payment is for. This part's optional but it's always a good idea. Many companies require you to write an invoice or account number on the memo line when you're paying a bill.

- Sign the check (on the bottom right line). No one can cash a check that's lacking a signature.

Below is an example of a filled-out check.

Advertisement