Personal Finance

This channel is where we explore the holistic health of your financial house. Helpful, accurate articles include topics on credit, debt management, financial planning, real estate and taxes.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

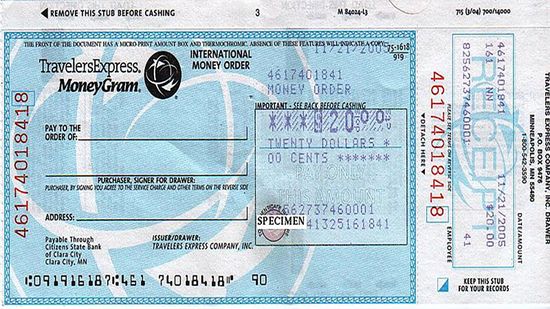

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More / Page 8

Maybe you sell repurposed lawn ornaments. Maybe you play in a video game theme music cover band. Whatever your hobby might be, if you make money from it, you've probably wondered whether the IRS expects a cut of your earnings.

Moving can be an exhilarating experience, especially if your new digs come with a fancy job and a big bump in pay. Why not keep the good vibes flowing by mastering a few tax-deductible tricks before the big move-out day?

If you're lucky, you'll never have to know about bankruptcy. But sometimes, even lucky people get dealt bad hands. If you're wondering whether to declare bankruptcy, here are 10 things you should know before doing the deed.

By Dave Roos

Advertisement

Even though you're declaring bankruptcy, you sure hate to part with your family jewelry or that expensive, new telescope. Could you hide your assets, or is that considered fraud?

Given the short careers of most pro athletes and their sometimes extravagant lifestyles, it is not shocking that many run out of cash. But some who live relatively modestly still end up with money troubles. Why's that?

By Dave Roos

After many Target customers had their credit card information stolen in fall 2013, the store chain offered them free credit card monitoring for a year. But does this service really help protect against identity theft?

By Dave Roos

Long popular in Europe, Latin America and other parts of the world, chip and PIN credit cards are now becoming the norm in the U. S. What took them so long to catch on in America and do they really lessen credit card fraud?

By Dave Roos

Advertisement

As you get ready for the fun task of paying your taxes, questions might form a cloud over your head: "Am I getting the biggest refund I can?" "Why do we have to pay taxes anyway?" We'll make that little cloud disappear with our answers.

By Dave Roos

Ever wish you could inherit a chunk of change from a long-lost relative? The next best thing might be money you've forgotten about but are still entitled to claim. We'll tell you where to look.

By Dave Roos

According to one study, the cost of a college education rose more than 1,000 percent between 1978 and 2012. We examine reasons for the jump, and look at why some say it's not that bad.

By Dave Roos

Is this the payment method of the future? No cash, no credit card, just your smartphone and your finger to pay for whatever you want? Welcome to the world of Square.

By Dave Roos

Advertisement

The American Dream has usually meant that U.S. children will do better financially than their parents. But is this being upended by all the economic downturns of the 2000s? Can millennials overcome their poor economic start?

By Dave Roos

Land trusts have been used for both good and bad. They can be created for environmental conservation or to keep housing affordable. Or they can be a way to disguise the true owner of a property. Let's look at the pros and cons of land trusts.

By Dave Roos

Every now and then you'd like (or really need) a little extra cash. So how can you scare it up with not too much effort? We've got some smart ways.

By Dave Roos

Having no job doesn't have to equal having no money. There are many ways to make a little cash without having to put in a day's work.

By Dave Roos

Advertisement

The average American changes jobs every four years, according to the Bureau of Labor Statistics. If you're average, that means you'll have a lot of 401(k)s before you retire. Should you consolidate them into one retirement account?

By Dave Roos

Lemonade stands and paper routes might have worked for your parents, but they're so yesterday. What projects can a kid do now that will earn a nice amount of spending money?

By Dave Roos

After you leave a job, what do you do with your 401(k) if you're laid off or going to a job with no similar plan? You can take a transfer or rollover of your cash. We explain the difference between the two.

By Dave Roos

The unsexily named "long-term municipal bonds" are pretty important to our everyday lives. They pay for building schools or highways in our neighborhoods. And almost anyone can buy one.

Advertisement

Moving all your credit card debt to one card may see like a great deal, and sometimes it is. How do you decide whether consolidation is the best approach to tackling your unsecured debt?

Most college graduates leave school with a significant debt load, and it often takes years to pay off that education. Is it better to lump loans together? What are the pros and cons?

Few people thought the Facebook stock price would slide after its IPO, which goes to show there are many risk factors, even in a so-called sure stock. What are some of the top factors?

By Dave Roos

Founded as an offshoot project of Occupy Wall Street, the Rolling Jubilee aims to buy distressed loans and pay off debt for consumers who will in turn hopefully give back to the organization and help others. But can it work?

By Dave Roos

Advertisement

If you're not energy-smart, your natural gas bill could really add up over the cold winter months. Fortunately, there are several ways to keep your natural gas bill low.

With all of the different types of car insurance available, it might seem like some are unnecessary. But is that really the case?

By Jeff Harder