Money orders are useful for transactions where you can't or don't want to use cash, a personal check, a bank or cashier's check, or a credit card.

Money orders have certain advantages, like being fairly safe to send through the mail because they can be tracked, and they don't let the recipient see any of your bank information. There are disadvantages, too, because you have to go purchase them at an issuer, such as a bank, a Western Union store or a United States post office branch, and you have to pay a fee every time you use one, making them more expensive than many other forms of payment. You also must fill out a money order correctly, otherwise it will have to be canceled and refunded, and then repurchased. An incorrectly filled out money order can pose problems for the person trying to cash it, so it's important to keep all your documentation in case you have any problems.

Advertisement

Before you go to buy a money order, make sure you know what types of payment are accepted. Cash is generally a safe bet, and other sources of funds, such as traveler's checks and debit cards, are likely accepted. You probably won't be able to use a credit card or personal check, because the issuer of the money order would lose that money if the credit card was later reported stolen, the check was canceled, or other problems occurred that put the validity of the funds in dispute. If the issuer does accept credit cards, your credit card issuer will likely treat the purchase as a cash advance, which will probably incur hefty fees on your next credit card bill.

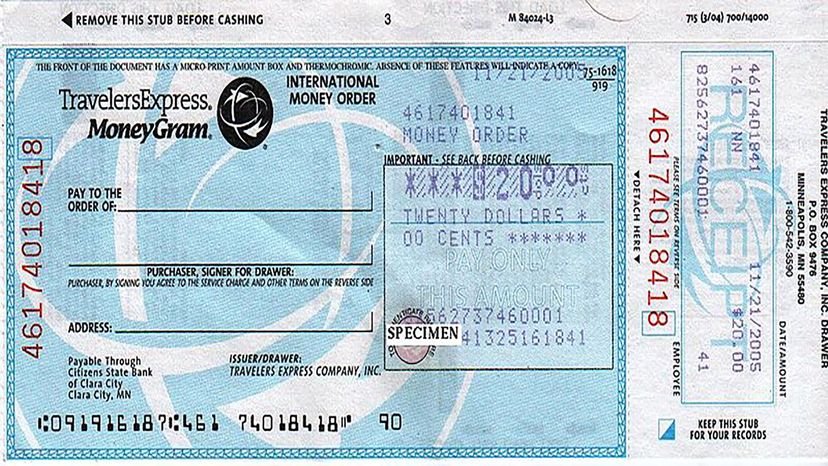

The requirements for filling out a money order will vary slightly depending on where you get it, but will generally require the name and address of the recipient, the payment amount and your signature. The amount will be printed when the money order is prepared by the issuer, but you'll fill in everything else. Here's how to fill one out correctly:

- Fill in the recipient's name (whether it's a person or a business) in the field marked "Payee," "Pay To," "Pay To the Order of" or some variant on this general theme. Make sure the name is spelled correctly, otherwise the recipient may not be allowed to cash the money order. Don't leave the Payee field blank; if it is blank, the money order can be cashed by anyone and you're losing out on its primary security feature.

- Fill in your name in the "From," "Purchaser" or "Purchaser, Signer for Drawer" field, though this only appears on some money orders.

- Fill in the recipient's address and your address, if required, depending on the type of money order.

- Include notes about the transaction in the "Memo" field if there is one. If the money order is being used to pay a bill, make sure to write your account number here.

- Sign the money order in a "Signature" or "Purchaser" field, if one is required. This will appear on the front of the money order. Do not sign the back; that's where the recipient signs.

- Check it twice – once you've verified that everything is correct, you can send it on its way.

- Last step – be sure to keep your receipt for your records.

Advertisement