Debt Management

There are many ways to keep debt down and your credit score up. In Credit & Debt Management, topics include credit reports, bankruptcy, how credit cards work and new technology.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More

So, your friend who promised to pay you back as soon as he got his paycheck is now avoiding you like the plague. Why is this happening and how can you avoid it in the future?

By Alia Hoyt

The last thing you want for your child is to have their identity stolen before they're old enough to open a credit card. The good news is there are ways to protect them from financial fraud.

You've lost your job and gotten behind with your rent. You know your landlord is looking for you. What's the best way to handle this and avoid eviction?

By Dave Roos

Advertisement

If you need money in a hurry, there are numerous ways to get it. But many quick loan options come with serious drawbacks.

A personal loan is a great way to pay for small-scale home renovations, but for bigger jobs, a home equity loan or line of credit may be a better option.

Lenders don't ask your reason for wanting one, but our experts discuss some typical motivations for taking out a personal loan.

Taking out a personal loan can be a great way to fulfill a short-term goal or finance a dream, but there are definitely some mistakes to avoid.

Advertisement

Personal loans generally are installment loans that can be obtained without collateral. They have many uses and may be cheaper than running up a big credit card balance.

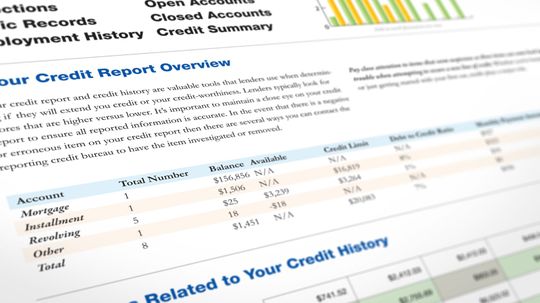

U.S. Federal law mandates that you get a free credit report each year through a government website. But lots of copycat websites have sprung up offering the same information for a charge. How can you be sure you're on the right page?

By Dave Roos

Credit monitoring bureau Equifax was hacked and is offering fraud monitoring services for free. But experts say they're pretty useless.

By Dave Roos

The amount of available income you have after taxes, or disposable income, makes all the difference in whether you can file for bankruptcy.

Advertisement

Some people end up filing for bankruptcy due to credit card debt, but that doesn't necessarily mean that you can't get a credit card again.

Filing bankruptcy doesn't mean losing every single asset that you own; some of your assets may be considered exempt by the court.

If you get behind on your bills due to a specific life event, a hardship letter can help convince your creditors to help you get back on track.

Deciding to file for bankruptcy is difficult enough. Now you have to figure out the terminology used to describe your debts.

Advertisement

U.S. citizens aren't the only ones who can file for bankruptcy in the U.S., but it sure can complicate things if you file and you're living in the country illegally or applying to become a citizen.

Getting a flu shot while you have the flu makes no sense, and so does planning to protect your assets after you've already entered into bankruptcy. Here's what to do beforehand.

Have you ever wondered how courts find out about your expenses and income during bankruptcy proceedings? That's asset discovery in action.

It's difficult, but not impossible. Ready to learn how you might secure a loan after a bankruptcy?

Advertisement

After one spouse declares bankruptcy, the other one could be left paying off the debts. Wait, really?

Current hiring trends and practices can create catch-22 scenarios for those looking for work post-bankruptcy. Could your career be affected?

If you're lucky, you'll never have to know about bankruptcy. But sometimes, even lucky people get dealt bad hands. If you're wondering whether to declare bankruptcy, here are 10 things you should know before doing the deed.

By Dave Roos

Even though you're declaring bankruptcy, you sure hate to part with your family jewelry or that expensive, new telescope. Could you hide your assets, or is that considered fraud?

Advertisement

After many Target customers had their credit card information stolen in fall 2013, the store chain offered them free credit card monitoring for a year. But does this service really help protect against identity theft?

By Dave Roos

Long popular in Europe, Latin America and other parts of the world, chip and PIN credit cards are now becoming the norm in the U. S. What took them so long to catch on in America and do they really lessen credit card fraud?

By Dave Roos