Retirement Planning

Wondering how to retire early? Looking to build a nest egg? Learn everything you need to know about retirement planning with this guide.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

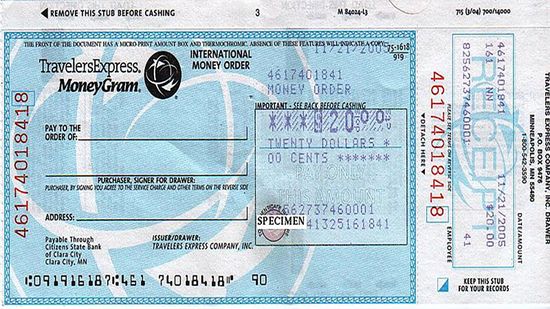

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More

If you are looking for the pension-friendly states, you are really asking where retirement income is taxed the least and predictability is highest.

If you are researching the tax-friendly states for retirees, you are really asking how to stretch retirement income on a fixed income.

Not all Social Security services are available online. And you don't have to be over 65 to visit the office either.

By Dave Roos

Advertisement

Presidents like to take credit for increases in Social Security, but is it the president, Congress or the Social Security Administration that decides when your check goes up?

There's a movement called FIRE, a group of people working hard to retire young and really enjoy life. But is it realistic to think you won't run out of money?

By Dave Roos

You've heard of the Roth IRA, but what about the Roth 401(k)? Many employers are offering them in addition to traditional 401(k) plans. So what's the difference?

By Susan Sherwood

Losing a parent is a harrowing experience, but being financially lost when it happens only makes matters worse. Find out how to navigate the waters of loss without finding yourself on a sinking fiscal ship.

Advertisement

Most companies offer their employees a 401(k); about half also offer a Roth 401(k) though not many employees use it. But in some cases, a Roth 401(k) might be the better option for you.

Knowledge of your current financial situation, and a degree of clairvoyance, goes far in determining which of your employer's retirement plans is right for you.

By Susan Sherwood

After decades spent in service of your country, your military pension is a well-deserved benefit. It's also income, and therefore subject to being taxed.

By Debra Ronca

A pension is an employer-provided benefit that supplies income when you retire. When and how it's taxed, though, has a lot to do with how you paid into the pension.

By Debra Ronca

Advertisement

Every American worker and employer contributes to a common retirement fund known as Social Security. When it comes time for you to collect benefits, you'll need a few important pieces of information before you apply. What are they?

By Dave Roos

You've worked hard to put a substantial amount of money into your retirement nest egg. Don't shortchange yourself by erroneously borrowing from or cashing out your fund early. Here's how to get every last dime out of your 401(k).

By Chris Opfer

401(k) accounts are designed to help people save for retirement, so there are harsh penalties for withdrawing funds early. That said, there are exceptions to the rule -- but there aren't many.

By Dave Roos

Roth IRAs are a smart way to save for retirement because you can avoid most of the tax penalties associated with other retirement plans -- as long as you follow the rules. What are the Roth IRA withdrawal rules, and how could they affect your retirement?

Advertisement

Even though you're no longer working, that doesn't mean your money should stop working, too. Read on for tips on where you should keep your money after retirement.

It's a rare accountant who thinks dipping into an IRA is a good idea, because tapping into that fund can be expensive. However, some people do cash out their IRAs early. What are the main reasons for doing this?

By Dave Roos & Denise Harrison

More than half of all Americans haven't figured out how much they need to save for retirement. Read on if you're one of them.

These days, it can be hard enough to pay bills, much less save enough for a down payment on a house. If you want to buy a home sooner rather than later, can you cash out your IRA to help cover the costs?

Advertisement

For many people, retirement is the art of balancing less money with more free time, and many businesses know that money is tight in retirees' pockets. What are some breaks you can look forward to in retirement?

By Garth Sundem

It's a document many people find unsettling, but in the event of a health crisis that leaves you incapacitated, a living will ensures that your treatment wishes are honored. We'll take you through the steps it takes to create this document.

If you want to be a millionaire by the time you retire, you have to start planning today. The solution to managing your future funds is at your fingertips: It's your computer's keyboard. Online banking is a smart way to swaddle that nest egg.

At some point, you'll likely want to stop working. At some point, you'll also have to figure out how to pay the bills once you retire. Here are 10 tips to help you out.

By Josh Clark

Advertisement

Working for yourself is challenging and sometimes daunting, but it's the single best decision that you ever made. And being the boss gives you substantial control when choosing a retirement strategy, which may include a Keogh retirement plan.

It's a sad but common story: A landowner dies, leaving his heirs in a mound of debt and back taxes. What do they do now? An estate freeze trust can prevent the heirs from falling into this extreme burden.