Personal Income Taxes

Taxes are inevitable, but if you are educated, you can soften their impact. Learn about tax and money organization, income taxes and other topics in the Taxes channel.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

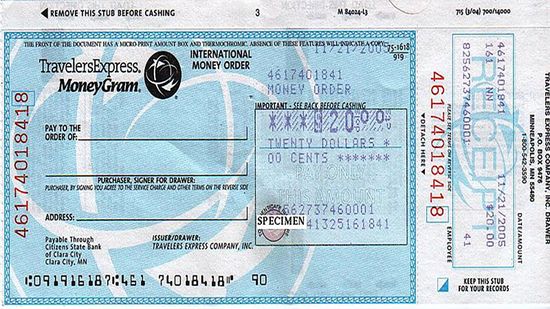

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

Learn More

Want to keep more of your crypto gains? Then you're probably wondering about crypto-tax-free countries.

If you are researching the crypto-friendly countries, you are really asking where digital assets are legally supported, reasonably regulated, and taxed in predictable ways.

Property taxes can feel like a second mortgage. But in some places, the annual bite is surprisingly small. These are the states with the lowest property tax rates, based on the effective property tax rate—the percentage of a home's market value homeowners pay each year.

Advertisement

Looking to keep more of your paycheck? Some U.S. states make it a lot easier. The states with the lowest taxes generally offer a friendlier environment for individuals and businesses alike, cutting back on income, sales, and property tax burdens.

Want to keep more of your paycheck? One way is to live in one of the states with the lowest income tax rates.

Property taxes may not grab headlines like income taxes, but they can take a serious bite out of your budget. So, which places hit homeowners the hardest?

For residents of certain states, the absence of a state income tax can be a significant tax benefit. Instead of paying personal income tax rates to the state, individuals in these states only pay federal income tax on their taxable income.

By Mack Hayden

Advertisement

At least 30 countries have return-free filing systems, including Denmark, Sweden, Spain and the United Kingdom. Why doesn't the U.S.?

FUTA, the Federal Unemployment Tax Act, was written into law in 1939 in response to the Great Depression and, as we discovered during the COVID-19 pandemic, it still has great relevance today.

Americans didn't always pay income taxes. When did that start and what was behind the creation of the IRS?

By Dave Roos & Jane McGrath

While many Americans have seen their tax refunds go down under the new tax laws, we have some strategies to increase your tax refund.

By Dave Roos & Denise Harrison

Advertisement

Taxpayers in the U.S. were accustomed to taking a personal deduction off their taxes for themselves and their dependents. But the tax reform laws have eliminated that. So, will their taxes go up or down?

By Dave Roos

You've probably heard the phrase "tax deductions" a hundred times. But what does it mean? And how can you be sure you're taking all the tax deductions you're entitled to?

Pago en Especie allows artists to meet tax obligations with a piece of art, and the government builds an impressive collection. Win-win!

By Chris Opfer

Whether you pay taxes on eBay sales depends on whether this is a casual hobby or a serious money-maker for you. But the rules may be changing.

Advertisement

You have a shop on Etsy, while your partner owns an online travel agency. Should you both have tax ID numbers?

Although you can't write off home improvements on your taxes, there are several ways you can get tax breaks for home renovations if you follow the guidelines.

If there's anything certain in this world, it's that kids ask tons of questions. Sure, you may know what to say when they ask why dogs bark or why the sky is blue, but when your kids want to know about paying taxes, what should you tell them?

Saving money is not the only reason to consider doing your taxes yourself. Sometimes, you are your own best accountant. Here's why.

By Alia Hoyt

Advertisement

You get two things when you donate to a charity: a feel-good moment and a tax deduction. And donations don't have to take the form of a cash or check. Property and goods and services count, too - sometimes.

Nobody wants their business to operate at a loss. But come tax time, you might at least be able to get some help if your business is in the red.

By Susan Sherwood

This might be the scariest phrase in the English language: tax audit. But not every missive you receive from the IRS is going to be bad news.

By Susan Sherwood

Sometimes called the Fair Tax, a consumption-based tax is often touted as the answer to the country's tax problems. But could it work?

Advertisement

Applying for a federal tax ID number couldn't be simpler. All you need is a computer, a telephone or access to a post office.

By Susan Sherwood

With so many people living in one state and working in another these days, taxes can be more complicated than ever before. Here are 11 tax tips to remember when filing.

By Dave Roos & Laurie L. Dove