Personal Finance

This channel is where we explore the holistic health of your financial house. Helpful, accurate articles include topics on credit, debt management, financial planning, real estate and taxes.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

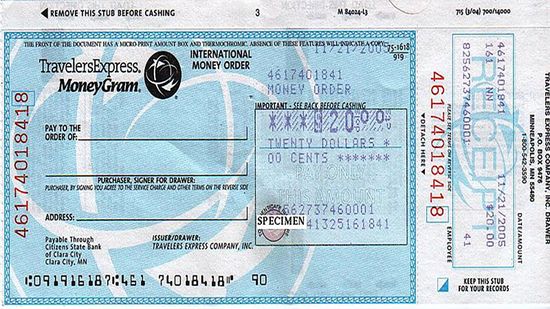

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More / Page 22

So, you want to be a lawyer. You've got a stellar GPA, and you've chosen the law school you want to attend. There's only one thing left to do before you can complete your application: take the LSAT. Why does this test instill fear and dread in so many students?

By Bambi Turner

It won't be long now before the banks come looking for that money they lent you to go to college. How do you pay it back? It all depends on what kind of loan you have.

If you want to be a doctor when you grow up, you'll have to get past the MCAT first. The Medical College Admissions Test is the most brutal aspect of the medical school admissions process, but you can crack it with a little help and a little practice.

By Dave Roos

Advertisement

When embarking on a college career, it pays to be curious. The more questions you have, and the more comfortable you are asking them, the better you'll be able to evaluate the colleges you have in mind.

By Sara Elliott

For many high school students, college looms as the place where they'll form lifelong friendships, take tentative steps toward a chosen career and -- oh -- educate themselves further. Is a college visit necessary to pick a good school?

For most people who pursue higher education, a college degree is the end of the line. But for others, it's simply a launching point to a post-graduate education. What do you need to know before you start applying to grad schools?

By Julia Layton

If you apply early decision, you might increase the likelihood that you'll be accepted into your dream college. But will you hurt your chances to receive financial aid?

Advertisement

Picking the right college is about more than just academics. Everything from the dining hall's menu to the cleanliness of your dorm affects your experience. To get a taste of co-ed life, you'll have to visit the campus.

A scholarship is a gift of money that funds your college education. You don't have to be a star football player or straight-A student to get one, but you do need some scholarship savvy. Consider this your crash course in securing cash for college.

When it comes to credit, a little discipline and diligence go a long way. You could call each of the three credit bureaus and compare their reports side by side, or you can order a 3-in-1 credit report and save some time.

By Dave Roos

For something so relatively easy to obtain, credit can easily cause a careless borrower lots of stress. Here are 10 simple ways to build credit -- and keep it.

By Dave Roos

Advertisement

Minimum wage is supposed to ensure that workers get paid enough to live. So why do some people think it should be abolished?

By Dave Roos

Investing may seem complicated, but there are ways to build your portfolio while minimizing risk. What's the best plan for diversifying your investments?

By Dave Roos

The faster April 15 approaches, the more rushed we are when we prepare our taxes. And that's never good news where mistakes or the IRS is concerned. So which errors do we make the most?

Financial planners will tell you that creating your own personal budget is a great way to help you find your way out of debt. How hard is it to write a budget and stick to it?

By Dave Roos

Advertisement

At some point, you'll likely want to stop working. At some point, you'll also have to figure out how to pay the bills once you retire. Here are 10 tips to help you out.

By Josh Clark

In the late 1970s, all U.S. airlines were deregulated giving carriers the authority to set their own prices. Without regulated fares, budget airlines began to form. But exactly how do they cut costs?

A staycation doesn't mean taking the laptop into the backyard and working from hom; it's about relaxing and exploring your own part of the world. So how do you make sure your staycation stays interesting?

By Julia Layton

You can rent to own a high-definition TV for just a few dollars a week, no credit required. It seems like a good deal, especially if you can't afford a new TV. If it's so great, why doesn't everyone do it?

By Dave Roos

Advertisement

It's a piece of advice you've probably heard: Don't pull your credit report too often, or you'll hurt your score. But what's a soul to do when you're shopping around for the best interest rates on a new house or car? How often can you look at your re

By Jane McGrath

Everyone knows that the things we buy at retail are marked up so vendors can make a profit. But the final cost depends on what you're buying -- and where you buy it.

By Dave Roos & John Kelly

Shopping online is so easy that people forget that it's fraught with pitfalls. You can buy anything you want with a mouse click, but you have to be careful on the Internet.

By Josh Clark

Cash, credit or debit? You're probably thinking that's not much of a choice since it's all money anyway. That's not exactly true, and you could get burned if you're not careful.

By Josh Clark

Advertisement

Extended product warranties are a good thing -- most of the time. However, under certain circumstances, it would be in your best interest to ignore the hard sales pitch and steer clear.

By Josh Clark

So you don't know what to buy your dad for Christmas. Maybe you can't wrap a gift to save your life. Whatever the reason, more people are giving gift cards these days. Buyer beware: They have more hidden strings than you may realize.