Personal Finance

This channel is where we explore the holistic health of your financial house. Helpful, accurate articles include topics on credit, debt management, financial planning, real estate and taxes.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

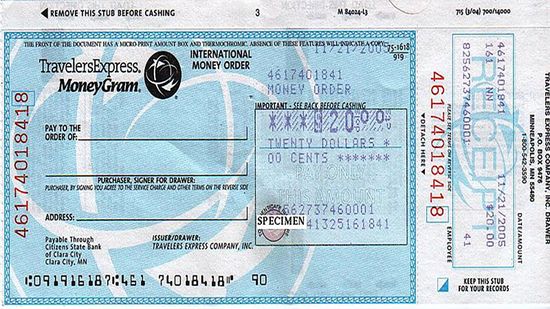

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More / Page 23

Money woes can take a toll on your health and relationships. But the good news is that there are things you can do to lower your financial stress right now. Take a deep breath, slow down and check out our list.

By Jane McGrath

You can start investing even with a modest income. There's no need to keep procrastinating until the time is right. As little as $25 a month could get you closer to the life you dream of.

By Dave Roos

Flat tax. FairTax. Bumper stickers and blogs tout them as solutions to income tax rates. But how could these plans change the way Americans are taxed on the money they earn?

By Jane McGrath

Advertisement

Banks do much more than just hold (and repurpose) the money you give them. From mobile banking to international banks to bank alternatives, get a glimpse into the world of banking in our image gallery.

Maybe keeping up with the Joneses is running you into the poorhouse. But will cutting out your luxuries make your friends think you're in dire straits?

By Jane McGrath

If you have debt, if you're saving for retirement, or if you just have general questions about your finances, you might consider a certified financial planner. They're not used only for the rich and famous to keep track of their huge incomes.

You've prudently pinched pennies to build your nest egg. But with the recent failures of First Republic and Silicon Valley banks, should you worry about losing your money if your bank goes bust?

Advertisement

When you buy a stock future, you're not actually buying shares of stock. Instead, you're making a contract to buy or sell shares on a certain date in the future.

By Dave Roos

Some people hate it, and others love it. Maybe you pay full price just to avoid the hassle of negotiation. Or, perhaps you get your thrills from haggling with the used-car salesman.

By Jane McGrath

If your fantasy is to be a hotshot investor, municipal bonds may give you the chance. These tax-free securities help towns and cities build sports complexes, hospitals, bridges and more.

By Dave Roos

Your phone service is taxed and your cable TV channels carry an added charge, too. So why is your Internet service exempt?

By John Fuller

Advertisement

During a routine car check-up, a service attendant announces to you that it will take $500 to repair your car. Normally, this cost wouldn't be a big deal, but this month you had to pay your income taxes, and you took a hit. How are you going to pay for the repairs?

A line of credit can help cover large, unexpected expenses like surgery fees that your medical insurance doesn't cover. With this type of loan, you don't start repayments until you borrow the funds.

The year was 1933, and financial ruin was everywhere. Enter the FDIC, created by U.S. Pres. Franklin D. Roosevelt to ensure that bank customers didn't lose their money if a bank failed. In 2008, a new financial crisis loomed. What did the FDIC do?

By Dave Roos & John Barrymore

With taxes and medical expenses increasing, it isn't hard for U.S. workers to get discouraged. Nothing is more frustrating than working hard all year, just to have the government and the pharmacy take your money. But flex funds may help you save.

Advertisement

Most college students have to worry about paying for classes, books, food, and rent. They have to work jobs, study to keep their grades up, and show up for classes on time. So the government began offering Pell Grants to students in need.

When you car breaks down, or you take those morning trips to the latte shop, you incur non-fixed expenses. Reviewing your budget, you'll see that they can fluctuate from one month to the next.

Trendy clothes. Daily Starbucks coffee. All the newest CDs. In budgeting, these common spending habits are identified as discretionary expenses. Discretionary expenses can be a reward, or they can wreck your budget. So what's your weakness?

You have a big expense coming up. You need a better car or home, or you want to go back to college. What do you do? Borrow, borrow, borrow -- right? Well, maybe not. Working off of a budget just may save your sanity -- and credit.

Advertisement

It lurches forward, seemingly unstoppable by the arsenal of data you've collected against it. You battled this foe years ago, but like the undead, it's come for you again and again -- this time in the form of letter from a collection agency. It's name? Zombie debt.

Dealing with debt collectors is becoming a common experience. But what can you do to avoid debt-collector harassment, short of switching off your phone service or allowing your unread mail to pile up on the kitchen counter?

Oil prices are rising; reserves of oil, coal and natural gas are being depleted; and the continued use of nonrenewable fuels poses threats to the environment. The answer may be alternative energy, but who's going to pay for it?

Tax-free mutual funds are a good investment option for conservative investors, since they have very little risk. Investors save money on taxes and can also easily convert shares into cash.

Advertisement

Trust funds aren't just for rich kids, although this concept dates back thousands of years. Limited-term trusts can protect your assets from lawsuits and other threats. It's all up to you.

You might think that with all the litigation taking place these days lawyers would top the list of best-paying gigs. But that's not the case at all. In fact, the best-paying job has a lot to do with making sure you're relaxed, while the worst-paying job has everything to do with ensuring that you're sated.