Personal Finance

This channel is where we explore the holistic health of your financial house. Helpful, accurate articles include topics on credit, debt management, financial planning, real estate and taxes.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

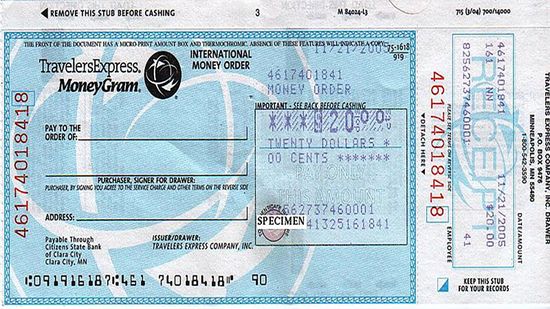

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More / Page 24

When you clean out your closet, you may donate items to charity or raise some extra cash with a garage sale. But what do you do when you have to clean out an entire house? An estate sale may be the answer you're looking for.

What goes up most come down. But how much do war, crime and inflation factor into stock market performance -- and is it all psychological? So how can you ride the bull and tame the bear?

Working for yourself is challenging and sometimes daunting, but it's the single best decision that you ever made. And being the boss gives you substantial control when choosing a retirement strategy, which may include a Keogh retirement plan.

Advertisement

It's a sad but common story: A landowner dies, leaving his heirs in a mound of debt and back taxes. What do they do now? An estate freeze trust can prevent the heirs from falling into this extreme burden.

Investment scams are popular fraud among con artists and can take the form of everything from a too-good-to-be true stock investment to the notorious Nigerian bank account e-mail scheme. So what it is about these cons that have us going against our better judgment? And what does it say about our own capacity for greed?

You get a letter in the mail, a letter emblazoned with the gut-wrenching acronym, IRS. You say to yourself: "But I filed on time! I paid all my taxes!"" How does the IRS decide who to audit?

A tax shelter sounds like a nice idea. It helps you reduce your tax burden to the IRS. There are many legitimate tax shelters, but some can be used for wrongdoing.

Advertisement

You might be on your last dollar, but it's not always a reason to sing the blues. In fact, in the strange world of taxation, your last dollar could actually put you in a higher tax bracket. So what does that mean for you and your money?

Charitable contributions are a great way to simultaneously help people in need and give yourself a tax break. But are there restrictions on what you can claim on your taxes?

You sign your Form 1040, seal it up in an envelope and send it off to the IRS. But then, you're shuffling through your file cabinet when you come across a W2 you forgot to file. What now?

To some people, it may mean clean drinking water or gasoline. Although these are really important commodities, they may or may not qualify as liquid assets. What is as fluid as cash?

By Jane McGrath

Advertisement

You're worth your weight in gold, even though you may not have the cash to show for it yet. But what you can get right now is your net worth.

By Jane McGrath

Imagine having a money club with your neighbors to earn money from its profits, and to finance your own mortgages. That's why S&Ls were created, although many folded during the 1980s and 90s.

Your finances are in the red, and you don't know where to turn. Agencies specializing in non-profit debt consolidation promise to help you out but you wonder if it's a scam.

You may already know that you need to pay property taxes on your real estate. But what about your car, the new boat you just bought, or even Fido? Depending on what state you live in, you could have to pay personal property taxes.

Advertisement

With just a few clicks, keep tabs on your investments, get the latest market news and peek at the pay stubs of high-paid CEOs. Google Finance offers these features when you set up your personal portfolio.

There's more to gold and platinum than just bling-bling. These and other precious metals can be alternative investments that put ching-ching in your pockets in the long run through a precious metals mutual fund.

If you've been slapped with an overdraft fee greater than your check or debit charge, you may wonder whether you need all your money in the bank. There are options to banking.

By Jane McGrath

Buying your first home can a dream come true, but it can quickly turn into a nightmare. Realistic planning is key to avoiding the pitfalls that await first time homebuyers.

By Jane McGrath

Advertisement

With so much information available online through public records, almost anyone can find out your personal information like your home's floor plan and where your children go to school. Privacy trusts can shield your information.

Some people are so deep in debt they feel hopeless like there's not way out. But one agency helps people take control of their finances, wipe out debt and budget for a new home.

Most engaged couples believe that their marriage will last "until death do us part." But with two out of every five marriages resulting in divorce, some couples decide that the best way to be prepared for any eventuality is to draw up a prenuptial agreement.

Ever absentmindedly tossed out a credit card bill or checked your bank balance from a computer at the library? Mistakes like these could pave the way for fraud.

Advertisement

No one likes to think about their own death. It would be nice if we could live as if we were immortal, never having to worry about what will happen after we're gone. But death is inevitable, and we all need to plan for it.

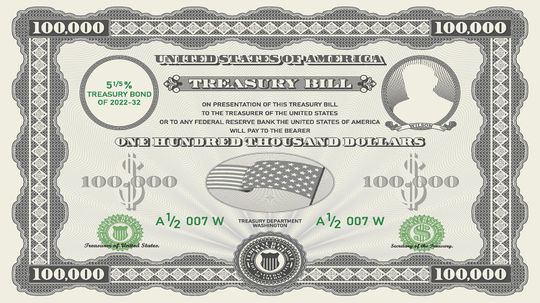

Treasury bills are a low-risk investment - and you don't need a lot of money to get started. How does the U.S. government use these bills to manage its debt?

By Dave Roos & Sarah Siddons