Personal Finance

This channel is where we explore the holistic health of your financial house. Helpful, accurate articles include topics on credit, debt management, financial planning, real estate and taxes.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

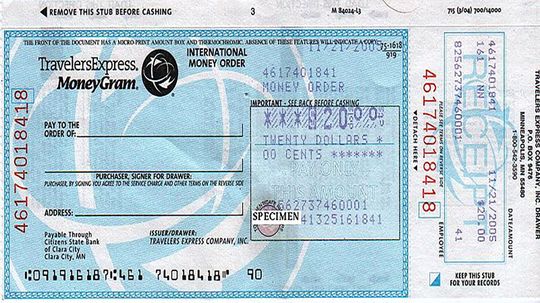

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More / Page 2

If money was no problem, how much would you spend on a car, painting or house? We've got the items with the biggest price tags here.

Although the day of turkey, football and gathering together has remained a distinctly American holiday, the shopping day afterward has gone global in a big way. How did that happen?

By Alia Hoyt

The old-school savings bond is suddenly hot again, thanks to its inflation-protected interest rate.

By Alia Hoyt

Advertisement

At least 30 countries have return-free filing systems, including Denmark, Sweden, Spain and the United Kingdom. Why doesn't the U.S.?

So, your friend who promised to pay you back as soon as he got his paycheck is now avoiding you like the plague. Why is this happening and how can you avoid it in the future?

By Alia Hoyt

FUTA, the Federal Unemployment Tax Act, was written into law in 1939 in response to the Great Depression and, as we discovered during the COVID-19 pandemic, it still has great relevance today.

The Bureau of Labor Statistics report that showed a 9.1 percent inflation rate for June has many people concerned. Here are some smart money moves to make in inflationary times.

By Dave Roos

Advertisement

Sometimes a money order is the best way to conduct a financial transaction, but knowing how to successfully fill one out is key.

A lot of people don't like to think about death, which is why many estates go unplanned. But if someone dies without a will, their survivors may end up in a long expensive fight in probate court.

By Alia Hoyt

Not all investment professionals are fiduciaries - we've got four questions that smart investors need to ask a financial adviser before putting him or her in charge of their investments.

By Dave Roos

The last thing you want for your child is to have their identity stolen before they're old enough to open a credit card. The good news is there are ways to protect them from financial fraud.

Advertisement

You've lost your job and gotten behind with your rent. You know your landlord is looking for you. What's the best way to handle this and avoid eviction?

By Dave Roos

Student loan refinance and student loan consolidation are completely different beasts. If you're weighed down with student loan debt, you need to know the difference.

Refinancing your student loans seems like a no brainer. But is it always a good idea?

If you need money in a hurry, there are numerous ways to get it. But many quick loan options come with serious drawbacks.

Advertisement

A personal loan is a great way to pay for small-scale home renovations, but for bigger jobs, a home equity loan or line of credit may be a better option.

Lenders don't ask your reason for wanting one, but our experts discuss some typical motivations for taking out a personal loan.

Taking out a personal loan can be a great way to fulfill a short-term goal or finance a dream, but there are definitely some mistakes to avoid.

Personal loans generally are installment loans that can be obtained without collateral. They have many uses and may be cheaper than running up a big credit card balance.

Advertisement

You might be confused by the difference between term and whole insurance, as well as all the other life insurance products out there. Or whether you even need life insurance in the first place.

By Dave Roos

"How low will my new interest rate be?" is not the only question to ask before you refinance your mortgage. Here are five others you should think about.

By Alia Hoyt

So you have homeowners insurance, but do you know exactly what you will need in order to file a claim when the time comes?

The annual cost of homeowners insurance can vary by hundreds of dollars and depend on many different factors. How can you save money on this necessary expense?

Advertisement

You'd like to take advantage of the low interest rates out there to refinance your mortgage, but your credit is less than stellar. Is it worth even trying to refinance?

By Alia Hoyt

Homeowners insurance generally is required only if you have a mortgage on your home. But even when your home is paid off, you'd be wise to maintain coverage.