Personal Finance

This channel is where we explore the holistic health of your financial house. Helpful, accurate articles include topics on credit, debt management, financial planning, real estate and taxes.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

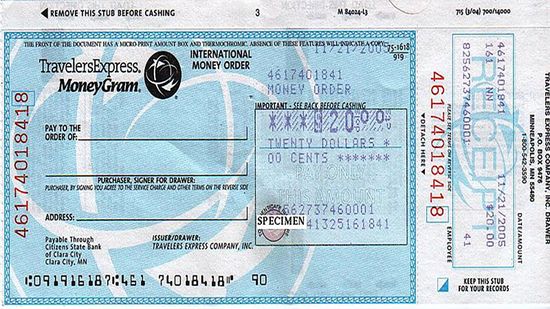

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

Cheapest Cigarettes by State: Where Average Cigarette Prices Haven't Skyrocketed

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

Learn More / Page 3

Homeowners insurance generally is required only if you have a mortgage on your home. But even when your home is paid off, you'd be wise to maintain coverage.

Need some extra cash to take care of some debts? You could tap into your home equity through a cash-out mortgage refinance. But what are the pros and cons?

By Alia Hoyt

Many people think the only life insurance payout option is a lump sum after the insured person dies, but there are actually many choices out there. We look at some of them.

By Dave Roos

Advertisement

Do you have to have a relationship with the person, or can it be any old Joe?

By Dave Roos

Life insurance is one of those adult-type things that everyone needs to think about, but not everyone needs to buy. Do you need life insurance and, if so, how much?

By Dave Roos

How much you pay for life insurance can vary on tons of factors, including your age, gender and even your favorite hobbies.

By Dave Roos

Many people don't write checks anymore - or didn't grow up having to fill them out. Still, there are times when the old check is the most convenient (or only) method of payment. So how do you fill one out?

Advertisement

Even if you have no need for a checkbook, you still need your bank's routing number to set up online payment. So where do you find it?

Not all Social Security services are available online. And you don't have to be over 65 to visit the office either.

By Dave Roos

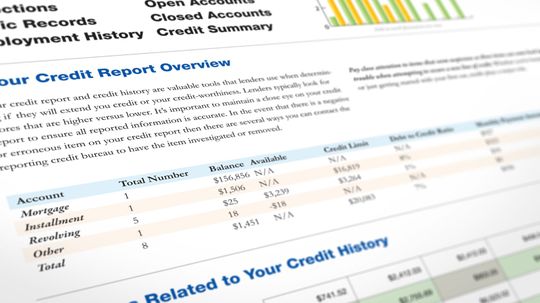

U.S. Federal law mandates that you get a free credit report each year through a government website. But lots of copycat websites have sprung up offering the same information for a charge. How can you be sure you're on the right page?

By Dave Roos

Americans didn't always pay income taxes. When did that start and what was behind the creation of the IRS?

By Dave Roos & Jane McGrath

Advertisement

While many Americans have seen their tax refunds go down under the new tax laws, we have some strategies to increase your tax refund.

By Dave Roos & Denise Harrison

Taxpayers in the U.S. were accustomed to taking a personal deduction off their taxes for themselves and their dependents. But the tax reform laws have eliminated that. So, will their taxes go up or down?

By Dave Roos

In good times and bad, dollar stores seem to thrive. But how are they are able to make so much money selling things so cheaply?

By Dave Roos

Presidents like to take credit for increases in Social Security, but is it the president, Congress or the Social Security Administration that decides when your check goes up?

Advertisement

There's a movement called FIRE, a group of people working hard to retire young and really enjoy life. But is it realistic to think you won't run out of money?

By Dave Roos

Check out these five clever strategies financial experts suggest for saving a ton of money each year.

By Dave Roos

Hurt feelings are likely to result but experts say there are times when you should leave more money to one child in your will. Just don't keep everyone in the dark about it.

By Dave Roos

You've probably heard the phrase "tax deductions" a hundred times. But what does it mean? And how can you be sure you're taking all the tax deductions you're entitled to?

Advertisement

Credit monitoring bureau Equifax was hacked and is offering fraud monitoring services for free. But experts say they're pretty useless.

By Dave Roos

Pago en Especie allows artists to meet tax obligations with a piece of art, and the government builds an impressive collection. Win-win!

By Chris Opfer

Millions of people have figured out how to get by without a bank account, whether by choice or force of circumstance.

By Oisin Curran

Starbucks holds as much cash for its customers as a midsize bank does, says the Wall Street Journal. Gift cards have helped the company to build a prepaid empire.

By Julia Layton

Advertisement

Whether you pay taxes on eBay sales depends on whether this is a casual hobby or a serious money-maker for you. But the rules may be changing.

You have a shop on Etsy, while your partner owns an online travel agency. Should you both have tax ID numbers?