Personal Finance

This channel is where we explore the holistic health of your financial house. Helpful, accurate articles include topics on credit, debt management, financial planning, real estate and taxes.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

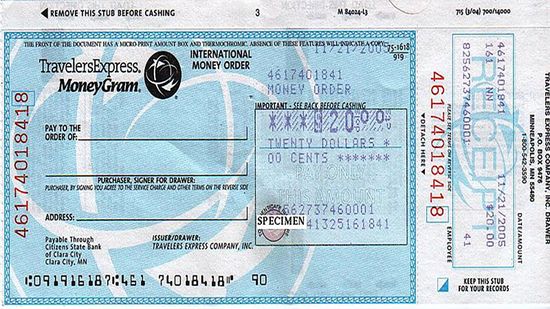

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More / Page 16

All supermarkets sell products for more than cost. But some products are marked up beyond reason. Which items are ripping you off?

By Debra Ronca

The transition from adolescence to adulthood is a difficult one for both children and parents. Fortunately, there are movies out there that compress the long and rocky road to adulthood into a 90-minute, family-friendly story that gives parents and teens something to talk about.

Gone are the days of cheap beer in the fridge and a bag of chips on the table. You're a grown-up now, and your parties should reflect that. But that doesn't mean you have to break the bank to impress your guests.

Advertisement

Dinner parties done right are fun and memorable, and your guests will keep coming back for more. But that doesn't mean you have to spend a mortgage payment to get it right. Now, more than ever, you can wine and dine on a budget.

By Sara Elliott

There's a popular myth that the IRS says paying taxes is voluntary, so no one has to do so. While that's untrue, certain wage earners are exempt from paying taxes. Who are these folks?

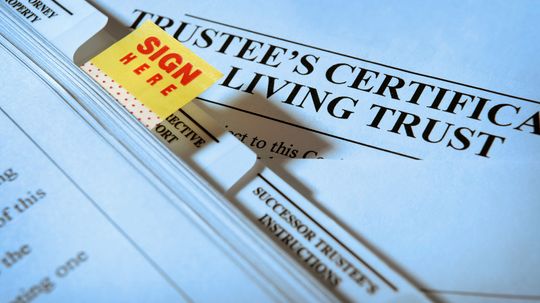

There have always been wealthy kids living off money they've inherited, but a trustafarian is a rich kid like none other. So who are these trustafarians and where did the term come from?

It's a rare accountant who thinks dipping into an IRA is a good idea, because tapping into that fund can be expensive. However, some people do cash out their IRAs early. What are the main reasons for doing this?

By Dave Roos & Denise Harrison

Advertisement

It may sound crazy, but there are lots of reasons why you might want to give your inheritance a second thought before cashing that check. Why would you disclaim an inheritance?

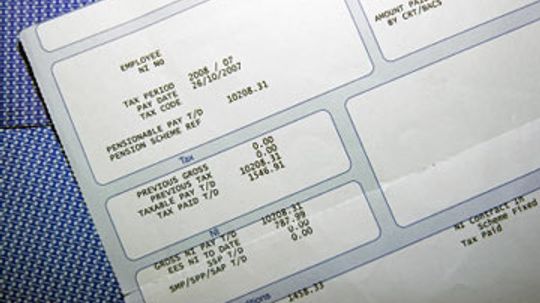

Saving money from your paycheck every week may sound daunting, but it's essential if you plan on retiring some day. But just how much do you need to save, and how do you do it?

The average consumer spends more than $600 on cleaning supplies each year, from sprays and soaps to sponges and vacuums. But with a little cleverness and comparison shopping, you can save some green while still keeping it clean.

Most people take up hobbies for fun, and even ones that seem free (like running and hiking) can turn into a money sink in a hurry. Here are 10 hobbies that can turn into money-makers instead.

Advertisement

More than half of all Americans haven't figured out how much they need to save for retirement. Read on if you're one of them.

These days, it can be hard enough to pay bills, much less save enough for a down payment on a house. If you want to buy a home sooner rather than later, can you cash out your IRA to help cover the costs?

For many people, retirement is the art of balancing less money with more free time, and many businesses know that money is tight in retirees' pockets. What are some breaks you can look forward to in retirement?

By Garth Sundem

While trust funds, or trusts, may seem the province of the wealthy, there are actually many benefits to creating one, even if you're not a multimillionaire.

Advertisement

Alternative investments have become increasingly popular, and they don't have to take the place of the traditional assets in your portfolio. But they do have some drawbacks, so read on and educate yourself before you spend a dime.

By Matt Sailor

When ATMs entered our daily lives in the '80s, an industry grew around the goal of making banking and living more efficient. But what can you do at an ATM aside from withdrawing cash?

Gold can be a wise way to diversify your investment portfolio. But how do you invest in this precious metal? Is it as simple as walking to the jewelry store and stocking up?

By Matt Sailor

Dating is already stressful enough without having to worry about money. What are you going to wear? Where will you go and what will you say? But when you're working with a tight budget, you can still be creative and have a fun time on your date.

By Jane McGrath

Advertisement

Even though your bank offers a variety of convenient services, chances are they're not free. And regulations now require banks clearly state all of their fees upfront, but that doesn't mean we expect them.

What can you do if you're not happy with your health insurance? Are you stuck with it or are there better options available? Find out the answer here.

Anyone who has battled medical bills and insurance companies knows how frustrating they can be. But there are ways you can negotiate those medical bills down -- and keep your sanity.

If you're looking for a new place to put your money, it pays to concentrate on finding the right bank for you. What are some of the different things to consider for both your present needs and future financial growth?

Advertisement

Knowing how to manage your money is a valuable skill, regardless of the state of the economy. And in today's tech-savvy climate, an array of tools can help you do just that. Read on to see the top 10 tech tools for managing your money.

From the outside, banks and credit unions seem very similar, but under the surface, the two types of financial institutions couldn't be more different. What are the differences between banks and credit unions?