Personal Finance

This channel is where we explore the holistic health of your financial house. Helpful, accurate articles include topics on credit, debt management, financial planning, real estate and taxes.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More / Page 17

Online banking is simple and convenient, but it's easy to be wary of managing your money via the Internet. And with both credit card and identity thefts still on the rise, should we assume that online banking is really safe?

The average family of four spends anywhere from $561 to $1,285 a month at the supermarket. What are some items that you should always buy generic in order to save money?

Tax evasion challenges the idea that any publicity is good publicity, especially since there's more than a 90 percent conviction rate when the tax man takes a celeb to trial. Who are some of the most famous celebrity tax evaders?

By Garth Sundem

Advertisement

Up until 1833, failure to pay what you owed could and did land you in jail. Debtors' prisons forced offenders to pay not only their debts, but also their prison fees. But do debtors' prisons still exist today?

By Garth Sundem

Many of us think of generic or store-brands as being of lower quality than their high-priced counterparts. But is it really worth it to spend more on name brands?

The idea of risk in investments is largely a matter of perception, but while some investments consistently make money, others stand a greater chance of losing it. What are some of the riskiest investments out there?

How much money should you have in your savings account? Do you know? Find out how much in this article by HowStuffWorks.com.

Advertisement

With the exception of winning the lottery, making serious money takes time and effort. But there are legitimate ways to make extra cash to supplement your day job income. Check out 10 ways you can moonlight and end up with some dough to show for it.

By Matt Sailor

In times like these, when bankers are going to jail and your neighbors are losing their homes, it's human nature to worry about making one wrong move with money. Can one investment mistake ruin you?

Bargain hunters track down deals every day, and throughout the years, some of these have gone down in history. What were some of the biggest bargains of the 20th century?

By Garth Sundem

Buying groceries and other staples in bulk to save money seems like a no-brainer, but you can actually spend too if you're not careful. Which bulk purchases can waste your money instead of save it?

By Matt Sailor

Advertisement

These days ATM skimming is as easy as it looks in the movies -- and it's usually well camouflaged and hard to spot. But armed with some information, you should be able to spot a suspicious ATM when you see one.

Building a financial future, whether for retirement or simply for attaining your personal goals, all starts with saving. What are some easy ways to stash some cash for later?

Buying in bulk doesn't always mean you have to buy three gallons of everything to get a good deal. You have to play your cards right if you want to save a bundle. Here are a few things you actually should buy in bulk.

By Matt Sailor

Think investing in a racehorse is a good bet financially? Think again. Sure it's cheaper than buying a professional sports team, and but it's definitely a gamble that probably won't pay off.

Advertisement

If you find yourself unable to pay your bills, the bankruptcy process allows you to walk away. But what happens when you die? Do the banks and creditors you still owe money forgive your debt or do you bequeath your debt to your surviving family?

How much of your money is yours and how much you pay to toward your debt has a lot to do with how your debt got there in the first place. There are various reasons people go into debt. Read on to find out the most common.

Americans identify terrorism and government debt as the two most worrisome issues to American wellbeing. If Americans are so concerned about the government's debt, why aren't we worried about our own debt?

As the economy sours and investments in stocks, bonds and real estate skid, unusual investments can often net a financial windfall. But do you know which ones are the best bets and how to make money from them?

Advertisement

Imagine living life without any debt. Sound like a dream? It doesn't have to be. Whether you're a college student, or baby booming ready for retirement, living debt-free is possible.

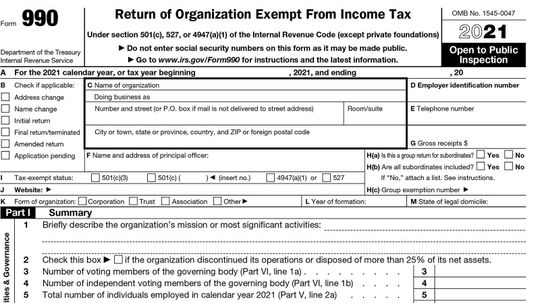

It isn't easy to become tax exempt, but it sure can make April 15 less stressful. So what type of organization qualifies?

Your homestead is your primary residence -- and that home of yours is protected by law. So, how do you receive property tax exemptions and guard against creditors when you face financial hardship?

You don't have to be super-rich to bid at an auction house. In fact, many auctions cater to all price points -- from clown portraits and Herman Miller chairs to airplanes. But you do have to possess a formidable will, not to mention a mean stink eye meant for fellow bidders.

Advertisement

It's a document many people find unsettling, but in the event of a health crisis that leaves you incapacitated, a living will ensures that your treatment wishes are honored. We'll take you through the steps it takes to create this document.

When planning a road trip, you should focus on having a good time, not on your trip's financial tally. But by the time you get home, your road-weary family could have racked up a huge credit card bill. Here are some tips for saving cash on your next trip.