Personal Finance

This channel is where we explore the holistic health of your financial house. Helpful, accurate articles include topics on credit, debt management, financial planning, real estate and taxes.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

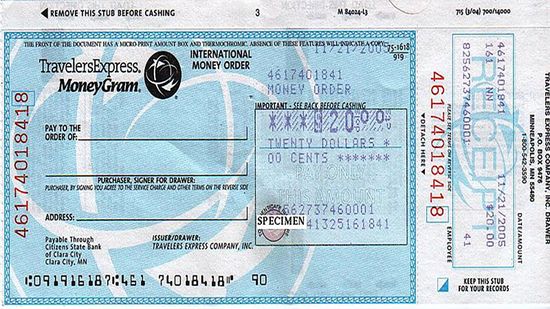

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More / Page 15

You lost your wallet and would like to find out how to get a copy of your Social Security card. Read this article to learn how to get a copy of your Social Security card.

You are approaching retirement age and you would like to learn how to apply for your Social Security benefits. Read this article and learn about how to apply for Social Security.

Every American worker and employer contributes to a common retirement fund known as Social Security. When it comes time for you to collect benefits, you'll need a few important pieces of information before you apply. What are they?

By Dave Roos

Advertisement

You've worked hard to put a substantial amount of money into your retirement nest egg. Don't shortchange yourself by erroneously borrowing from or cashing out your fund early. Here's how to get every last dime out of your 401(k).

By Chris Opfer

401(k) accounts are designed to help people save for retirement, so there are harsh penalties for withdrawing funds early. That said, there are exceptions to the rule -- but there aren't many.

By Dave Roos

Roth IRAs are a smart way to save for retirement because you can avoid most of the tax penalties associated with other retirement plans -- as long as you follow the rules. What are the Roth IRA withdrawal rules, and how could they affect your retirement?

Even though you're no longer working, that doesn't mean your money should stop working, too. Read on for tips on where you should keep your money after retirement.

Advertisement

Running a hotel is a complicated business -- not everything goes perfectly, and there are some secrets that most hotel managers would rather you not know. What are some of them?

Mutual funds are a wonderful investment, but they can be frustrating at times. Luckily, exchange-traded funds (ETFs) can be traded on the open market like stocks -- but are they as shaky as stocks?

Even if both of your parents are employed, you may be eligible for financial aid. Learn whether you can receive financial aid with two working parents.

If you find that you're falling behind in mortgage payments -- or if you're about to -- your best bet may be to negotiate a mortgage loan modification. This article explains how to negotiate a mortgage loan modification.

Advertisement

When money's tight, finding your IRS refund status can help with the budgeting. Learn about how to find your IRS refund status in this article.

If you're young enough to ride the ups and downs of market, some financial advisers recommend you put some of your money in more aggressive investments. But what makes one investment more "aggressive" than another?

By Beth Brindle

You want to make money with your investment portfolio, not lose it in the next market crash, right? So are there really any investments that are considered risk-free?

By Beth Brindle

Budget-conscious shoppers pride themselves on saving money and scoping out sales and steals. Retailers make a mint off customers who fall for too-good-to-be-true deals. Wise up by getting acquainted with these 10 tricks.

Advertisement

You walk into the grocery store with a specific list and a firm budget, and somehow, you end up spending more than you bargained for. Was it the two-for-one cereal where you went wrong, or the organic produce you upgraded for? Nah, your grocery store just tricked you.

By Echo Surina

With soaring prices and stagnant wages, balancing the family budget can be tough. How can you use the Internet to save you money?

By Bambi Turner

Who can resist a buy-one, get-one free sale? Or a sweater that's 75 percent off? It's smart to stock up when there's a good deal on your favorite goods, but what about the stuff that never goes on sale? Smart shoppers know that some things are worth the splurge.

The word "mortgage" comes from an old French phrase meaning "death pledge" and the concept of amortization comes from the same etymological root. Contrary to popular belief, the latter phrase isn't scary -- in fact, it makes paying your mortgage easier.

By Dave Roos

Advertisement

You spent your childhood wanting to be just like them. Then, during your teenage years, you did everything you possibly could to be nothing like them. Somewhere along the way, though, you did, in fact, become your parents. How did that happen?

By Sara Elliott

The holidays are alive with the sound of parties, and this year, it's your turn to get in on the hosting fun. We'll show you how to throw the ultimate holiday shindig without breaking the bank.

Now that you're all grown up with a place of your own, the first place to go shopping is your parents' house, of course. From dishes and clothes to special antiques, these 10 things should definitely make the move with you.

Would you believe it's possible to save more than 90 percent on your grocery bills? It takes measures many people would consider extreme, but saving serious money doesn't have to completely dominate your life.

Advertisement

We've all been there, wavering between the pretty box of the cereal you know and love and the less-lovely box that costs half as much. But is cereal (or medicine, for that matter) a good product to scrimp on?

By Julia Layton

Does it seem as if you're always running out of bread, milk and eggs? You're not alone. These are just three of the top 10 groceries Americans buy. What are some others?