Financial Planning

Saving for college, investing in the stock market, online trading, mutual funds for many, these topics are overwhelming. No worries. We'll give you accurate, easy-to-understand information in the Financial Planning section.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More / Page 3

When you buy a stock future, you're not actually buying shares of stock. Instead, you're making a contract to buy or sell shares on a certain date in the future.

By Dave Roos

If your fantasy is to be a hotshot investor, municipal bonds may give you the chance. These tax-free securities help towns and cities build sports complexes, hospitals, bridges and more.

By Dave Roos

Oil prices are rising; reserves of oil, coal and natural gas are being depleted; and the continued use of nonrenewable fuels poses threats to the environment. The answer may be alternative energy, but who's going to pay for it?

Advertisement

Tax-free mutual funds are a good investment option for conservative investors, since they have very little risk. Investors save money on taxes and can also easily convert shares into cash.

Trust funds aren't just for rich kids, although this concept dates back thousands of years. Limited-term trusts can protect your assets from lawsuits and other threats. It's all up to you.

When you clean out your closet, you may donate items to charity or raise some extra cash with a garage sale. But what do you do when you have to clean out an entire house? An estate sale may be the answer you're looking for.

What goes up most come down. But how much do war, crime and inflation factor into stock market performance -- and is it all psychological? So how can you ride the bull and tame the bear?

Advertisement

Investment scams are popular fraud among con artists and can take the form of everything from a too-good-to-be true stock investment to the notorious Nigerian bank account e-mail scheme. So what it is about these cons that have us going against our better judgment? And what does it say about our own capacity for greed?

To some people, it may mean clean drinking water or gasoline. Although these are really important commodities, they may or may not qualify as liquid assets. What is as fluid as cash?

By Jane McGrath

You're worth your weight in gold, even though you may not have the cash to show for it yet. But what you can get right now is your net worth.

By Jane McGrath

With just a few clicks, keep tabs on your investments, get the latest market news and peek at the pay stubs of high-paid CEOs. Google Finance offers these features when you set up your personal portfolio.

Advertisement

There's more to gold and platinum than just bling-bling. These and other precious metals can be alternative investments that put ching-ching in your pockets in the long run through a precious metals mutual fund.

With so much information available online through public records, almost anyone can find out your personal information like your home's floor plan and where your children go to school. Privacy trusts can shield your information.

Most engaged couples believe that their marriage will last "until death do us part." But with two out of every five marriages resulting in divorce, some couples decide that the best way to be prepared for any eventuality is to draw up a prenuptial agreement.

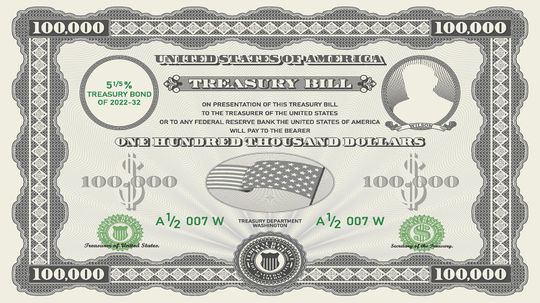

Treasury bills are a low-risk investment - and you don't need a lot of money to get started. How does the U.S. government use these bills to manage its debt?

By Dave Roos & Sarah Siddons

Advertisement

From learning to invest to protecting yourself in a volatile market, check out this image gallery for the big picture. Learn about investment types, the stock market and learn about a few investing pitfalls.

Life insurance is associated with pushy salespeople and other unpleasant stuff -- like dying. But how will your children make do if you should die unexpectedly?

By Dave Roos

Believe it or not, stock market fractions arose from the way the U.S. dollar measured up to Spanish currency way back in 1792, when the U.S. stock market was created. But what does any of that have to do with fractions?

Money market accounts are popular because they usually pay higher interest than savings accounts. So what's the catch? Why shouldn't we all open one?

Advertisement

When you open a mutual fund, you agree to pool your money with other investors for more purchasing power. How do mutual fund companies invest and track your portfolio? And why are mutual funds so popular?

By Dave Roos

Stock options can be beneficial for both employees and employers who provide them. Why do many employees prefer stock options to cold hard cash or better benefits?

The Dow Jones is one of several stock market averages designed as a quick and accurate way to measure the well-being of the market. Why do we hear so much about the Dow Jones in the news?

You made the vows -- for better or for worse, in sickness and in health -- but you don't remember agreeing to pay higher taxes. How does marriage affect your finances?

By Josh Clark

Advertisement

Your last will and testament is a very important document that ensures your wishes are carried out after you die. Many people think they need to be old, sick or wealthy to need a will. In truth, everyone of legal age should have one.

Some people use their will as an opportunity to send a message from beyond the grave. Learn about 9 strange last wills and testaments from Harry Houdini, Marie Curie, and more.