Debt Management

There are many ways to keep debt down and your credit score up. In Credit & Debt Management, topics include credit reports, bankruptcy, how credit cards work and new technology.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More / Page 2

Founded as an offshoot project of Occupy Wall Street, the Rolling Jubilee aims to buy distressed loans and pay off debt for consumers who will in turn hopefully give back to the organization and help others. But can it work?

By Dave Roos

If you find that you're falling behind in mortgage payments -- or if you're about to -- your best bet may be to negotiate a mortgage loan modification. This article explains how to negotiate a mortgage loan modification.

The word "mortgage" comes from an old French phrase meaning "death pledge" and the concept of amortization comes from the same etymological root. Contrary to popular belief, the latter phrase isn't scary -- in fact, it makes paying your mortgage easier.

By Dave Roos

Advertisement

Anyone who has battled medical bills and insurance companies knows how frustrating they can be. But there are ways you can negotiate those medical bills down -- and keep your sanity.

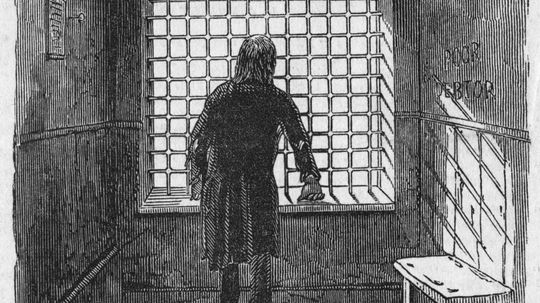

Up until 1833, failure to pay what you owed could and did land you in jail. Debtors' prisons forced offenders to pay not only their debts, but also their prison fees. But do debtors' prisons still exist today?

By Garth Sundem

If you find yourself unable to pay your bills, the bankruptcy process allows you to walk away. But what happens when you die? Do the banks and creditors you still owe money forgive your debt or do you bequeath your debt to your surviving family?

How much of your money is yours and how much you pay to toward your debt has a lot to do with how your debt got there in the first place. There are various reasons people go into debt. Read on to find out the most common.

Advertisement

Americans identify terrorism and government debt as the two most worrisome issues to American wellbeing. If Americans are so concerned about the government's debt, why aren't we worried about our own debt?

Imagine living life without any debt. Sound like a dream? It doesn't have to be. Whether you're a college student, or baby booming ready for retirement, living debt-free is possible.

You're finally behind the wheel of your brand new car. You're on easy street now, no more catching the bus or train for you. But wait, there's one thing left -- managing the car loan.

Your neighbor just got a cute new car. If only you could too. But how would you pay for a new ride? By doing what most car buyers do -- apply for a car loan.

Advertisement

Applying for student loans can seem like a daunting task when you're just getting started. But with a little bit of planning and patience, your efforts can really pay off.

When it comes to credit, a little discipline and diligence go a long way. You could call each of the three credit bureaus and compare their reports side by side, or you can order a 3-in-1 credit report and save some time.

By Dave Roos

For something so relatively easy to obtain, credit can easily cause a careless borrower lots of stress. Here are 10 simple ways to build credit -- and keep it.

By Dave Roos

It's a piece of advice you've probably heard: Don't pull your credit report too often, or you'll hurt your score. But what's a soul to do when you're shopping around for the best interest rates on a new house or car? How often can you look at your re

By Jane McGrath

Advertisement

It lurches forward, seemingly unstoppable by the arsenal of data you've collected against it. You battled this foe years ago, but like the undead, it's come for you again and again -- this time in the form of letter from a collection agency. It's name? Zombie debt.

Dealing with debt collectors is becoming a common experience. But what can you do to avoid debt-collector harassment, short of switching off your phone service or allowing your unread mail to pile up on the kitchen counter?

Your finances are in the red, and you don't know where to turn. Agencies specializing in non-profit debt consolidation promise to help you out but you wonder if it's a scam.

Some people are so deep in debt they feel hopeless like there's not way out. But one agency helps people take control of their finances, wipe out debt and budget for a new home.

Advertisement

Using a debit card is convenient but also comes with a certain amount of risk. What's the best way to protect yourself and keep an eye on your money?

If you're trying to work your way out of debt, consumer credit counseling might be a good step to take. What happens during, and after, the counseling session?

Your personal debt may seem like an enormous burden, but these pictures will help put it into perspective and remind you that even entire nations struggle to maintain a balanced budget.

When you swipe your credit or debit card through a reader, you start a process that involves the store you're at, your bank and ultimately your financial well-being. How does that little stripe send so many messages?

Advertisement

Bankruptcy chapters can be really confusing -- there are specific chapters for both business and personal filing. What do they all mean?

Many people wonder where they've gone wrong with their credit score. Was it charging a pack of gum with a credit card? A steep mortgage? Where does everyone else stand in terms of credit?

By Josh Clark