Debt Management

There are many ways to keep debt down and your credit score up. In Credit & Debt Management, topics include credit reports, bankruptcy, how credit cards work and new technology.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

10 Crypto-Tax-Free Countries (and Where to Find 'Crypto Valley')

10 Crypto-friendly Countries With Predictable Regulations

9 States With the Lowest Property Tax (and Just 1 Pacific Entry)

Learn More / Page 3

Life without debt sounds good. Can debt consolidation, or taking out one new loan to pay off all your other loans, help you reach that lofty financial goal?

By Jane McGrath

A low credit score can prevent you from getting the car, house or job of your dreams, but there's one surefire way to boost that three-digit number.

By Jane McGrath

Do you pay just the minimum on your credit card balance each month? If your credit limit keeps getting raised, beware: You might be a revolver.

By Dave Roos

Advertisement

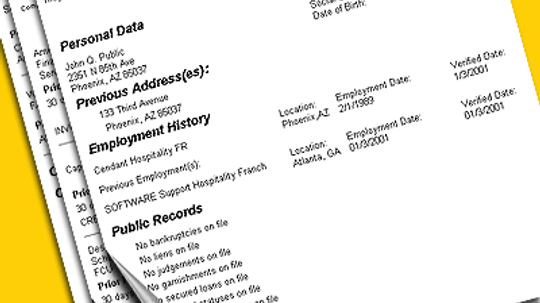

Credit reporting agencies collect your credit history from credit card companies, banks, mortgage companies and other creditors to create an in-depth credit report. But how is that report used?

By Dave Roos

The world is drowning in debt, and experts fill the airwaves with doomsday predictions. What exactly is this monster called debt that's sucking up all of our income, ruining our credit scores and making politicians sweat?

By Dave Roos

You saved up your money, got a home loan, got the keys and moved in. But now you've lost your job and you can't pay up. What happens to your house? Maybe foreclosure -- but there are ways to avoid it.

Interest-only loans let you afford a nice house and make low payments. But there's a catch -- once you have to pay up, circumstances may not be in your favor.

Advertisement

These days, more people buy with credit than with cash. Learn all about credit cards, from the numbering system to how you can get rid of that high-interest balance.

It's bad enough when an individual has to file for bankruptcy, but filings by high-profile companies like Adelphia can have a big impact on the economy. What exactly does it mean to file for bankruptcy?

Tired of all that time-consuming swiping at the register? Credit cards using contactless technology allow you to pay for stuff by holding the card near a special reader instead of handing it to a clerk or wondering if you slide it with the stripe facing up or down.

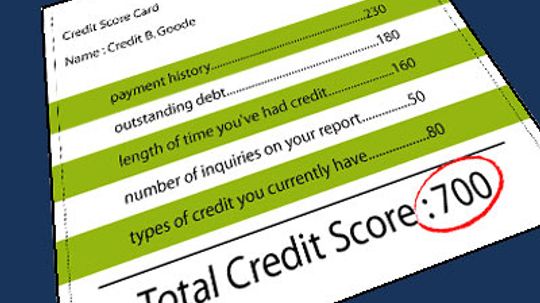

Do you know your credit score? If not, you should find out -- and we'll explain why. In this article, we'll examine how your three-digit credit score is used and how it affects what you pay for credit, insurance and other life necessities.

Advertisement

Like it or not, your credit score is a major factor in your financial well-being. But what do those numbers on your credit report really mean? And how will they impact your financial future?