Different jobs come with different perks. If you work at a wedding boutique, for instance, you probably get to try on all the gowns you want while twirling around in a mirror and calling yourself the prettiest princess. The president gets a free house and round-the-clock security. Refrigerator repair people probably get to swipe some pickles or something when the homeowner isn't looking. But as long as you're employed by someone else, you get another perk: your FICA taxes.

What, paying taxes doesn't sound as sweet as a Costco membership? Fair enough; we don't usually think of taxes as a perk. But here's the deal: If you do have an employer, they're actually obligated to pay half your FICA tax. Self-employed people, on the other hand, have to pay the entire tax themselves. So although you can't necessarily set your own hours and wear your pajamas to work like your freelance friends, you do benefit from a FICA break.

Advertisement

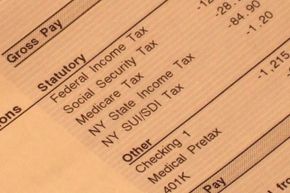

So now you know that if you're employed by someone you're not entirely responsible for the FICA tax, but we still need to discuss what it is. First off, it stands for the Federal Insurance Contributions Act, and it's actually two different taxes rolled together. Both Social Security and Medicare are funded through the tax, so when you're seeing FICA withheld you know it's going to the two programs. In fact, the more FICA you pay over your working years, the more retirement benefits you'll receive through Social Security.

So what amount is being taxed? It's actually different for both Social Security and Medicare. For Social Security, there's a 12.4 percent tax on your wages, but remember, you're only paying 6.2 percent of that amount [source: IRS]. Your employer pays the other half. Medicare is a 2.9 percent total tax, so you're being taxed at a 1.45 percent rate [source: IRS]. And one more thing to keep in mind: Social Security is only taxed up to a certain wage limit ($117,000 in 2014) [source: IRS]. So if you make more than $117,000, any wages in excess aren't taxed.

Under the Affordable Care Act, there is an Additional Medicare Tax levied on those who make more than $200,000 a year. For married people who file jointly, that threshold is $250,000, while the married filing separately number stands at $125,000. People who report incomes beyond those threshold amounts have to pay a 0.9 percent tax, which also will be automatically withheld. And don't expect an employer match for that one -- it's your responsibility alone.

To learn a lot more about taxes, read on for more info.

Advertisement