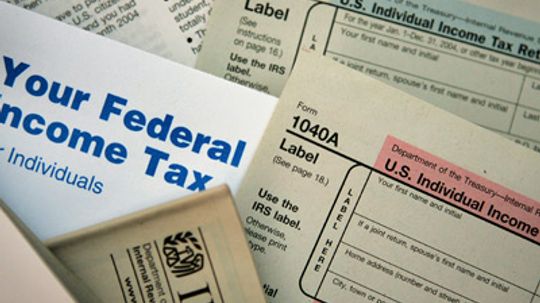

Personal Income Taxes

Taxes are inevitable, but if you are educated, you can soften their impact. Learn about tax and money organization, income taxes and other topics in the Taxes channel.

10 Types of Car Insurance Every Driver Needs to Know

5 Common Auto Insurance Scams (And How to Avoid Them)

How Auto Insurance Companies Work

10 Least Expensive States to Live In

What Are the Different Types of Life Insurance?

Do I Need Life Insurance?

How to Fill Out a Money Order

How to Write a Check

How to Find Your Bank's Routing Number

Motel vs. Hotel: Differences in Overnight Accommodations

10 Things Hotels Don't Want You to Know

How Family Road Trips Can Be Done on the Cheap

How to Get Free Food While SNAP Benefits Are Delayed

11 Cheapest Halloween Candy Choices (and How to Shop Smart)

7 Best Chrome Extensions for Finding Coupons in 2023

5 Places That Will Pay You To Move There (Including 1 in Italy)

Can you use student loans to buy a used car?

What to Do When a Friend Owes You Money

How to Future-proof Your Child's Credit From Fraud

How to Avoid Being Evicted From Your Home

How Many Millionaires Are in the U.S.? More Than Any Other Country

8 Most Expensive Things in the World, From Parking to Palaces

Where Should You Put Your Money When Inflation Is High?

How Square Works

5 Ways Mobile Banking Alerts Can Benefit You

Is it safe to shop online with a debit card?

What's the Difference Between Student Loan Refinance and Student Loan Consolidation?

Is It a Good Idea to Refinance Your Student Loans?

10 Reasons College Costs So Much

9 Pension-friendly States for Retirees

10 Tax-friendly States for Retirees

5 Reasons You Might Need to Visit the Social Security Office

Learn More / Page 5

If you don't make a whole lot of money, the Earned Income Tax Credit can help put some much-needed cash in your pocket. Now all you have to do is claim it -- that is, if you qualify.

By Dave Roos

Income inequality is a hot topic now, but have the scales always been this imbalanced? Did we -- rich and poor alike -- pay more taxes in the past? As with many things involving the tax code, the answer is a little complicated.

By Dave Roos

Doing your taxes is already stressful enough, but imagine how much worse it could be if you forget to bring your identification or Social Security card. Here are a few more must-haves for your tax preparer.

By Dave Roos

Advertisement

To U.S. taxpayers, April 15 comes with lots of scrambling and sweating to send some cash or paperwork to the IRS. But why does Tax Day fall on that particular date? And why is it on April 18 sometimes?

By Dave Roos

The tax code -- a compilation of every tax law written by Congress since the Constitution was ratified in 1788 -- is ridiculously long and complicated, but who actually enforces it?

By Dave Roos

When money's tight, finding your IRS refund status can help with the budgeting. Learn about how to find your IRS refund status in this article.

There's a popular myth that the IRS says paying taxes is voluntary, so no one has to do so. While that's untrue, certain wage earners are exempt from paying taxes. Who are these folks?

Advertisement

Tax evasion challenges the idea that any publicity is good publicity, especially since there's more than a 90 percent conviction rate when the tax man takes a celeb to trial. Who are some of the most famous celebrity tax evaders?

By Garth Sundem

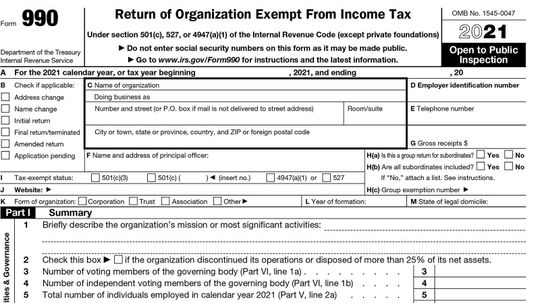

It isn't easy to become tax exempt, but it sure can make April 15 less stressful. So what type of organization qualifies?

Your homestead is your primary residence -- and that home of yours is protected by law. So, how do you receive property tax exemptions and guard against creditors when you face financial hardship?

The U.S. Social Security system acts as a giant safety net that provides financial help to retirees and younger people who have suffered a serious injury or illness. It also helps out the family members of those who have died or endured a disability.

Advertisement

Most working adults in the U.S. associate April 15 with frantic runs to the post office, but they might feel better about federal taxes if they knew what they paid for.

By Dave Roos

Sales taxes are more a pain in the neck than actual financial burden to the average consumer. What most don't realize is that these taxes are crucial to the health of some local economies.

State governments get some of their operating money from the federal government, but much of their funds come from a variety of taxes. And for many states, the largest source of revenue is income tax.

The faster April 15 approaches, the more rushed we are when we prepare our taxes. And that's never good news where mistakes or the IRS is concerned. So which errors do we make the most?

Advertisement

Flat tax. FairTax. Bumper stickers and blogs tout them as solutions to income tax rates. But how could these plans change the way Americans are taxed on the money they earn?

By Jane McGrath

Your phone service is taxed and your cable TV channels carry an added charge, too. So why is your Internet service exempt?

By John Fuller

You get a letter in the mail, a letter emblazoned with the gut-wrenching acronym, IRS. You say to yourself: "But I filed on time! I paid all my taxes!"" How does the IRS decide who to audit?

A tax shelter sounds like a nice idea. It helps you reduce your tax burden to the IRS. There are many legitimate tax shelters, but some can be used for wrongdoing.

Advertisement

You might be on your last dollar, but it's not always a reason to sing the blues. In fact, in the strange world of taxation, your last dollar could actually put you in a higher tax bracket. So what does that mean for you and your money?

Charitable contributions are a great way to simultaneously help people in need and give yourself a tax break. But are there restrictions on what you can claim on your taxes?

You sign your Form 1040, seal it up in an envelope and send it off to the IRS. But then, you're shuffling through your file cabinet when you come across a W2 you forgot to file. What now?

You may already know that you need to pay property taxes on your real estate. But what about your car, the new boat you just bought, or even Fido? Depending on what state you live in, you could have to pay personal property taxes.

Advertisement

Death tax. Estate tax. Inheritance tax. They all mean the same thing: The government imposes a tax on a grieving heir for any money they receive from the deceased. What is the tax that is levied, and how much will this tax cost you?

You already know that when you sell your stocks, you've got to pay taxes on the profits. But did you know you're supposed to pay taxes for selling your old comic books, too?

By Dave Roos