Economic Concepts

Economic concepts are widely used but not always defined clearly. Read up on the nature of capitalism, learn how much power the Fed really has and more.

Want to Support Veterans? 4 Tips for Finding Good Charities

No Shave November Is More Than Mustache Month

5 Questions to Ask Before Donating to a Charity

The Least Valuable Currency, Compared to the U.S. Dollar

What Is the Strongest Currency in the World?

The Fascinating Stories Behind 5 of the World's Big Currency Symbols

The 10 Countries With the Most Billionaires Span 4 Continents

How Many Billionaires Are in the U.S.? More Than Any Other Nation

The Richest Kid in the World Is Worth $5B — Which Royal Is It?

10 Worst Recessions in U.S. History, Listed Chronologically

Retaliatory Tariffs, Trade Wars, Crashing Economies, Oh My!

Why the U.S. Monthly Jobs Report Matters

Most Dangerous Cities in the U.S. by Cost of Crime per Capita

Who Paid the Largest Criminal Fine in History and Why?

How to Legally Change Your Name

Neighbor-spoofing Robocalls Are the New Nuisance

The 10 Most Counterfeited Products in The World

Crowdfunding or Crimefunding? Fraudsters Kickstart Money Laundering Campaigns

Why Big Companies Like Tesla and Amazon Are Splitting Stocks

What Time Does the Stock Market Open?

What Causes Stock Market Trading to Halt?

How to Volunteer to Help Disabled Veterans

10 Best Volunteer Activities in Retirement

Does the Peace Corps want retired volunteers?

Learn More

Often measured by GDP (gross domestic product), the size of an economy is often defined by the total value of all the goods and services produced the borders of a given country. This gives us a nice, round (and often very large) number to stick next to a country's name, which makes it easy to compare to other countries.

By Zach Taras

When you're choosing a place to live, the cost of living matters - a lot. While some states offer an affordable lifestyle, others place serious pressure on people's wallets year in and year out. So, which is the most expensive state to live in? And which other states should you avoid if you're worried about your budget?

By Marie Look

Western nations often think of the entire African continent as poor, thanks, in large part, to the legacies of the transatlantic slave trade and European colonialism. The truth is, many African countries were wealthy before colonization.

By Sascha Bos

Advertisement

Economists have historically used GDP per capita to determine the richest country in the world, but that's misleading when you consider the tax havens effect.

By Dave Roos & Talon Homer

Product shortages on everything from cars to computer chips have us all feeling a bit unbalanced. At the root of most is what economists call the "bullwhip effect." But what is it?

Sizzling temperatures across the globe aren't just bad for humans, they're bad for crops too. Harvests are smaller and that drives up food prices.

By Kate Yoder

Inflation in the U.S. was over 9 percent in June but many countries in Europe have even higher rates. What's causing the global spike?

Advertisement

An economist explains the difference between a true bear market and a correction, and whether a bear market always signals a recession is on the way.

High food and gas prices blowing your mind? Issues with the supply chain are causing prices to rise on everything from gas to groceries as inflation soars.

By Craig Austin

One of the vital statistics of a company or an individual is called the debt-to-equity ratio. But the key is knowing how to interpret this important metric in relation to future needs and investment plans.

By Dave Roos

Non-fungible tokens, or NFTs, are a way to turn digital art into an asset that can be stored in a blockchain ledger. They could revolutionize the art business. Still confused? Enter the brave new world of NFTs.

Advertisement

UBI stands for universal basic income, a guaranteed government cash payment. Pilot programs are testing whether having UBI improves lives. What have they learned so far?

By Dave Roos

Gas prices have plummeted across the U.S. since the coronavirus pandemic. That might be a good thing for your wallet, but is it good for the economy? It depends.

Economics law says that demand goes down when price goes up. But Veblen goods work the opposite way - when price goes up, so does demand. How do these goods get so lucky?

By Dave Roos

Good luck predicting the economic future; even the experts get it wrong. But there are sure warning signs to look for when a recession is ahead.

By Dave Roos

Advertisement

This economic policy has been embraced by free-market capitalists and demonized by progressive reformers. But what does it really mean?

By Dave Roos

Two gas stations might face each other on a street in Anytown, USA. Yet their gas prices might be different. Why is that?

Congress passed the new farm bill with a provision that will legalize hemp farming on an industrial scale. Could this be America's next gold rush?

By John Donovan

An inversion of the U.S. Treasury bond yield curve has predicted the last seven U.S. recessions. Is the U.S. in for another one soon?

By Dave Roos

Advertisement

Think "all you can eat" means you get more than you paid for? As one restaurant expert put it, "The house always wins."

By Dave Roos

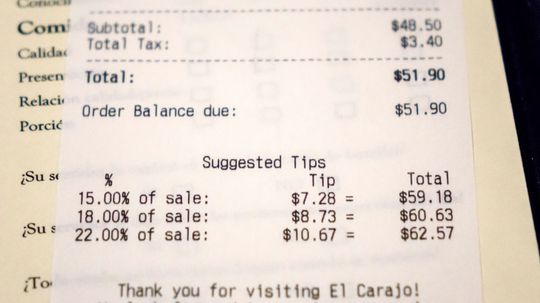

Some U.S. restaurants' experiments with dropping tipping in favor of higher menu prices did not catch on with consumers. Is there a profit point when it would make sense to drop tipping?

By Dave Roos

The online company has its fingers in just about every e-commerce enterprise; it's even caused many organizations to go out of business. Yet the U.S. government has not tried to stop Amazon's growth. Why's that?

By Dave Roos

We place faith in our money and financial systems. But have we put so much faith in them that we're not equate money and religion - or money to, ahem, our eternal salvation?

By Diana Brown

Advertisement

Saying that all it takes to succeed in the U.S. is effort and personal responsibility is an oversimplification of the actual circumstances surrounding poverty.

By Dave Roos

Burger consumption can predict more than your chances of gaining weight. It can also determine currency equality. Meanwhile, men's underwear is a good indicator of the state of the economy. But how?

By Dave Roos