Stock Market

Whether you're an economics wiz or don't know your NASDAQ from your Dow Jones, these articles will give you a deeper understanding of the forces at play in the stock market.

Want to Support Veterans? 4 Tips for Finding Good Charities

No Shave November Is More Than Mustache Month

5 Questions to Ask Before Donating to a Charity

The Least Valuable Currency, Compared to the U.S. Dollar

What Is the Strongest Currency in the World?

The Fascinating Stories Behind 5 of the World's Big Currency Symbols

10 Largest Economies in the World, Ranked by Nominal GDP

What's the Most Expensive State to Live In?

The Richest Countries in Africa, Based on GDP

The 10 Countries With the Most Billionaires Span 4 Continents

How Many Billionaires Are in the U.S.? More Than Any Other Nation

The Richest Kid in the World Is Worth $5B — Which Royal Is It?

10 Worst Recessions in U.S. History, Listed Chronologically

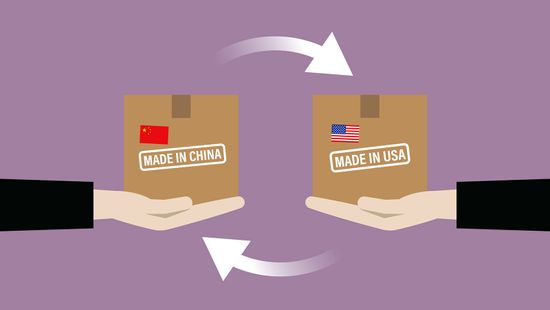

Retaliatory Tariffs, Trade Wars, Crashing Economies, Oh My!

Why the U.S. Monthly Jobs Report Matters

10 Landlord-friendly States (Spoiler: No West Coast Candidates)

Most Dangerous Cities in the U.S. by Cost of Crime per Capita

Who Paid the Largest Criminal Fine in History and Why?

Neighbor-spoofing Robocalls Are the New Nuisance

The 10 Most Counterfeited Products in The World

Crowdfunding or Crimefunding? Fraudsters Kickstart Money Laundering Campaigns

How to Volunteer to Help Disabled Veterans

10 Best Volunteer Activities in Retirement

Does the Peace Corps want retired volunteers?

Learn More

The market has changed. In 2026, retail investors aren't losing money because they’re bad at picking stocks—they’re losing because they’re fighting institutional AI algorithms with manual research.

Some of the biggest companies in the United States just announced stocks splits. What is a stock split and what does it signal to average investors?

By Dave Roos

The New York Stock Exchange has changed its hours many times since its inception in the late 18th century. Why? And what hours does it keep now?

Advertisement

During volatile periods in stock markets, exchanges will often employ "circuit breakers" to keep stock prices from falling too far too fast. So how do these work around the world?

By Dave Roos

Hedge funds might seem like something only the very rich have to think about but actually they are actually part of everyday life. What are they and why are they so risky?

Penny stocks may seem like a good deal because they're so cheap and who knows, they could make money! But penny stocks can also be places for scam artists, so how do you protect yourself?

By Dave Roos

Is that stock that's been lingering price-wise in the basement a good deal or just likely to down even lower? Can you tell whether a stock's price is going to go up or down without being psychic?

By Dave Roos

Advertisement

If you ever get a chance to buy a blue-chip stock, you'd jump on it -- but what if you can't afford to buy all the shares you'd like? You can open a margin account and borrow the money, but be careful: You can go completely broke if things go south.

If you've seen the end of the film "Trading Places," you know the potential outcome of a margin call. What is this terrifying thing -- and how do investors end up having to pay one?

By Dave Roos

Initial public offerings are as high as high finance gets. When popular, formerly private companies decide to offer shares of their stock to the public, the price of that stock can skyrocket. Here are 10 companies whose IPOs reached the stratosphere.

By Josh Clark

Investors line up to purchase a company's newly offered stock, sending the price into the stratosphere. But often, a highly anticipated initial public offering can tank too.

By Dave Roos

Advertisement

Before most people were even aware there was an economic crisis, investment managers looked for lucrative investments. What they settled on was oil futures, and those futures brought speculation.

By Josh Clark

Day trading used to be pretty risky business, but now it's a lucrative business. You could earn millions if you know the market and make quick, well-informed choices.

The NASDAQ display in NYC's Times Square is impossible to miss. It's the largest continuous sign on the square and takes up almost 9,000 square feet of display space -- about a quarter of an acre.

Find out what a NASDAQ IPO is and see cool videos from a recent HowStuffWorks trip to this Wall Street wonder.

Advertisement

The NASDAQ stock exchange, also known simply as the NASDAQ, is the place where people go to buy and sell shares of stock. How does this bustling business center work?

Millions of people trade billions of shares of stock every day on a collection of computer systems that are incredibly reliable and, very nearly, inerrant. Learn about the complex world of electronic trading.

The opening cross is NASDAQ's current technique for setting opening prices. Learn about NASDAQ's opening and closing cross.

Initial public offerings have been around for centuries - every company with shares that are publicly traded on the stock market had an IPO at one point. Find out what an IPO is and how it makes people rich.