Lending money is risky business. Remember that time your friend Bob borrowed $50 and said he'd pay you back the next day? You haven't seen Bob or your $50 in three years. If you had known that Bob had a long history of borrowing money from friends -- and not paying them back -- you probably wouldn't have lent him the cash in the first place.

Large lending institutions like banks, mortgage companies and other creditors take the same risk when they give loans to consumers for buying homes, financing cars and paying for a college education. Creditors attempt to minimize the risk of these loans by carefully examining the credit history of borrowers. If a borrower has a bad credit history, then the lender might not give him a loan, or may charge him a higher interest rate.

Advertisement

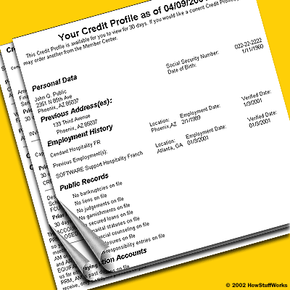

If you've ever owned a credit card or applied for a loan, then you have a credit history. Your credit history is compiled and maintained by companies called credit reporting agencies or credit bureaus. Credit reporting agencies collect your credit history from credit card companies, banks, mortgage companies and other creditors to create an in-depth credit report. The information in that report is also used to calculate a three-digit credit score.

Every time you apply for credit, the bank or credit card company calls up one or more of these credit reporting agencies to review your credit report and credit score. The lending institution will decide whether to extend you a loan -- and at what interest rate -- largely based on the credit history reported by those agencies.

Credit reporting agencies are powerful institutions. One bad entry on your credit report can cripple your borrowing power for years. Even worse, credit reports are often requested by employers, landlords and insurance companies. That's why it's so important to make sure that everything on your credit report is true and accurate. According to a 2004 study, one out of every four credit reports contains serious errors: debts wrongfully listed as delinquent, closed accounts listed as open, debts that belong to other people with the same name, et cetera [source: MSNBC].

For decades, the information collected by credit reporting agencies was hidden from consumers. Individuals had no idea why they were denied credit or whether or not their reports contained mistakes. Beginning with the Fair Credit Reporting Act in 1971 and continuing with recent legislation, U.S. citizens have free access to their credit reports and credit scores from each of the three national credit reporting agencies: Experian, TransUnion and Equifax. Citizens also have the right to know exactly why their credit was denied.

In this HowStuffWorks article, we'll explain how the "Big Three" credit reporting agencies work, your rights when dealing with them, and how to protect yourself against errors and fraud.

Let's start with the Big Three.

Advertisement