Without knowing it, you may live next door to one. Or have one among your Facebook friends. And with the right strategy, you could become a millionaire, too.

What, exactly, does it take to become a millionaire? If you're like me, you may envision Scrooge McDuck swimming the backstroke across a sea of gold coins, the spoils of a charmed life. The reality, however, is that most millionaires have built their wealth through scrappy perseverance and a diverse portfolio.

Advertisement

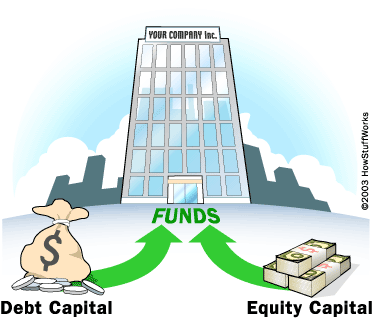

Millionaires are defined in different ways. RBC Wealth Management and consulting firm Capgemini who produce the World Wealth Report say it is someone who has $1 million or more in investible assets -- not including items like your primary home or consumable goods you own. On the other hand, international mega-bank Credit Suisse defines it as someone with a net worth of at least $1 million. This net worth could include the value of your primary residence, money that's been invested in real estate or trust funds (known as non-liquid assets), and cash, stocks or bonds (liquid assets) [source: Frank, Stern].

Using the former definition, there were 11 million millionaires in the world in 2011. Using the latter, you get 28.6 million millionaires on the planet [source: World Wealth Report, Peterson].

If you'd like to see how close you are to becoming a millionaire, figure your own net worth by adding the value of your assets: your home, its furnishings, your cars, bank accounts and investments. After you have a sum total, subtract your liabilities, which include the balance of your mortgage and car loans, credit card balances and other outstanding debts. What's left is your net worth.

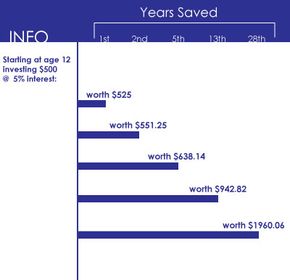

Not a millionaire yet? Don't get discouraged. This level of wealth is attainable within a lifetime. By making smart financial decisions and following a road map that includes a few key strategies, it's entirely possible to become a millionaire. It also means you'll need to live beneath your means, which is a far cry from the millionaire lifestyle many of us have become conditioned to expect.

Advertisement