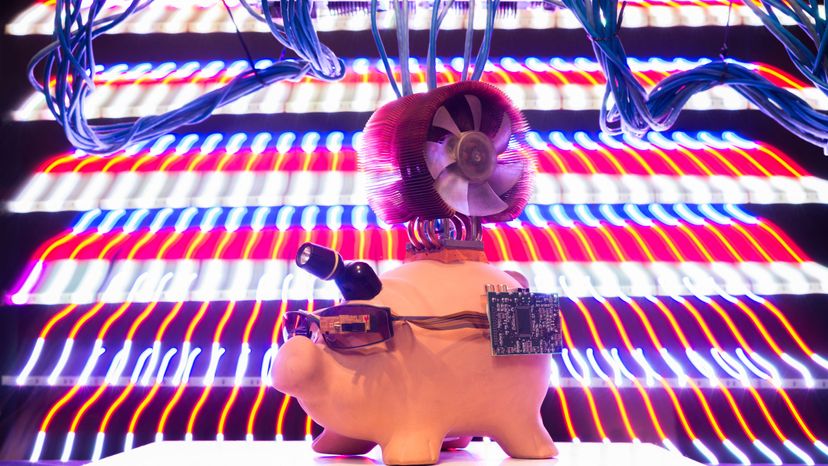

It's a bit like money ... and it's a bit like a financial bubble. It's Bitcoin, and it may be giving us a glimpse of the future of money.

Bitcoin is a type of virtual currency brought to life by the internet, very powerful computers and the willingness of lot of people looking to embrace new forms of monetary exchange.

Advertisement

Bitcoin shares some similarities with real-world currencies, particularly its growing acceptance as a form of payment with more and more merchants, retailers and individuals, both online and offline. You can buy Microsoft products with Bitcoin, buy airline tickets through Expedia, or buy gift cards to superstores like Walmart.

Yet Bitcoin is also very different from traditional currencies. Unlike dollars or pounds, Bitcoin isn't backed by any government. It's a completely decentralized form of money. Bitcoin isn't linked to any sort of central banking system or issuing authority, and that's a big part of its appeal — instead of being swallowed into a system that's often sullied by human greed and manipulation, this currency exists in an online world driven by mathematics and clever encryption protocols.

You can use Bitcoin for all sorts of real transactions. To do so, you first buy bitcoins however you like, either through your credit card, a bank account or even anonymously with cash. Then your bitcoins are transferred directly into your Bitcoin wallet, and you can send and receive payments directly to a buyer or seller without the need for a typical go-between, such as a bank or credit card company.

By skipping the middleman in the transaction, you pay far less in associated fees. Each party in the deal can also maintain a much higher level of anonymity, which has both pros and cons for everyone involved. Think of Bitcoin as a digital equivalent of a cash transaction. If you're so inclined, it's a nearly untraceable way to do business.

Spending or receiving Bitcoin is as easy as sending an e-mail, and you can use your computer or your smartphone. That simplicity belies the fact that there's a whole lot of complicated math protecting all of these transactions to maintain their legitimacy and security.

Keep reading to see more about the mysterious rise of Bitcoin, as well as the inner workings of the network that keeps this so-called "cryptocurrency" alive and kicking.

Advertisement