You get a text from your best college buddy saying to call him ASAP. On the phone, he can barely contain his excitement. His brother-in-law works at a popular high-tech company that's about to announce a revolutionary new product. Your friend is an active day trader — someone who buys and sells stocks online — and guarantees that the company's stock will soar on the news. If you invest $1,000 today, your shares will be worth twice that amount by the end of the week. He's going all in. What do you say?

With financial investments, there is no reward without risk. The riskiest bets, like short-term investments in a volatile stock market, can bring the greatest rewards, but also stunning losses. The truth is that your friend's "sure thing" is anything but, and investors need to understand how different risk factors can impact their financial future.

Advertisement

Even the most conservative investment, such as an FDIC-insured certificate of deposit (CD), carries a degree of risk. If the interest rate on the CD is too low, your investment might be outpaced by inflation [source: Financial Industry Regulatory Authority].

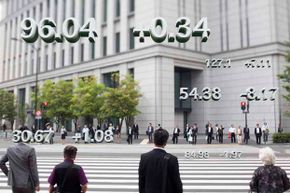

Smart investors try to manage risk by investing in a diverse portfolio of stocks, bonds, CDs and other financial instruments, often through a professionally managed mutual fund. But other investors prefer a more hands-on approach, buying and selling stock in individual companies, either through a broker or an online trading Web site. If you're thinking about investing in a particular company rather than a diversified mutual fund, you need to go with more than your gut instincts. You need to analyze the specific risk factors that come with every investment and every company.

Start by researching some basic questions: What do Wall Street analysts expect from the company's next earnings report? How does the company's historic stock price compare with market indexes like the Dow Jones Industrial Average? Has the company weathered the recession well? Is any member of the top management team under investigation? Are any of its exec selling off lots of their holdings?

We've compiled a list of 10 significant risk factors that can cause an investment to sink or soar. There's no way to remove all of the risk of investing — even your mattress loses to inflation — but by doing your homework, you can identify key trends and invest with greater confidence. Let's start with a look at the big-picture performance of an entire industry or sector.