Most of us are used to paying for things with either cash, credit or debit cards. Just making the leap to mobile payment apps like PayPal and Venmo still is a stretch for many people. So when it comes to cryptocurrencies like bitcoin, well, that's when things can get really perplexing.

That's why Stuff They Don't Want You To Know hosts Ben Bowlin, Noel Brown and Matt Frederick decided to dedicate two episodes of the podcast to discuss cryptocurrencies. And they invited along fellow HowStuffWorks podcaster, Jonathan Strickland, to break down all the technical intricacies that make cryptocurrencies possible in part one of this special series Cryptocurrency Conspiracies. (You can listen to part two of the series here.)

Advertisement

Cryptocurrencies like bitcoin are basically "invisible" digital currencies that users send via the internet. Bitcoin in particular has been in the spotlight recently due to the massive fluctuation in its value. But as volatile is it is, Bitcoin and other cryptocurrencies occupy a real corner of the global financial market, and could possibly change everything about how the world does business.

Cryptocurrency was the dream of many hackers because it represented a way for them to exchange money for products and services that was totally anonymous and divorced from a regulatory authority like banks or governments. But the security of these digital currencies, as well as how to keep people from double-spending or coding their own currency, remained a huge obstacle. That was until 2008, when the mysterious (and still unidentified) Satoshi Nakamoto published a white paper called "Bitcoin: A Peer-to-Peer Electronic Cash System," which essentially started bitcoin as we know it.

So how does all of this actually work? First, blockchain technologies depend upon peer-to-peer networks. On these networks, participants share certain assets on their personal computers across the rest of the network. In the case of blockchain technology, the asset is a ledger of all bitcoin transactions dating back to the earliest instances. Every computer on the network has access to this ledger, which helps prevent anyone from trying to cheat the system by spending the same digital unit of currency more than once.

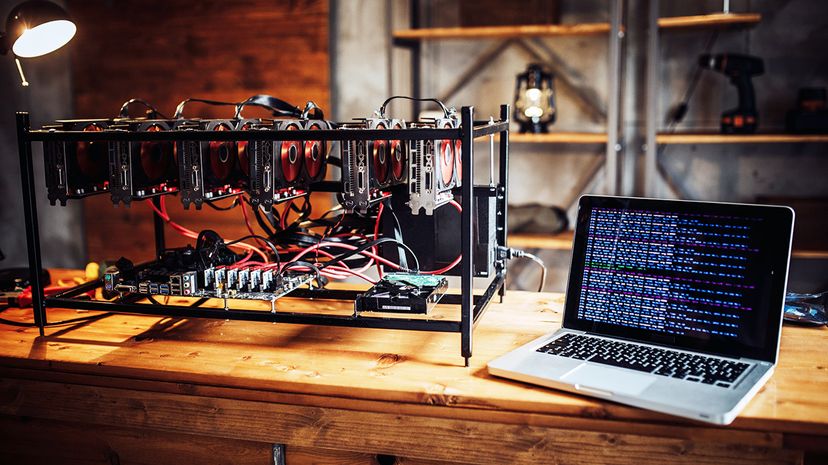

The bitcoin system groups new transactions into blocks and then issues a challenge to all computers connected to the network: Verify the transactions by solving a difficult math problem. The first computer to solve the problem gets some bitcoins as a reward. This process is called "mining."

It gets a bit more complicated after that. First, the difficulty of the math problem depends directly upon the amount of processing power connected to the network. Ideally, it should take about 10 minutes for a computer (or group of computers) to verify a new block of transactions.

Every so often, the system runs an analysis to see how much time it takes to verify a new block. If it takes computers less than 10 minutes, the system makes the problem even more difficult. If it takes more than 10 minutes to verify a block, the system eases off and makes the problem less complex. And to top it all off, there's a cap to the number of bitcoins that will ever be produced: 21 million. After the last bitcoin emerges, miners will earn a fee for verifying transactions but no new bitcoins will be created.

Bitcoins have earned a bit of a dark reputation due to how the system allows buyers and sellers to remain anonymous. It has become a popular currency for money laundering and black-market transactions. But after a Senate Banking Committee hearing in February 2018, bitcoin gained a bit more legitimacy, which made its value soar in a matter of hours. And now more businesses are accepting it in lieu of cash or credit.

That means there could be a real future in bitcoin, and as many enthusiasts point out, the true value is in the code itself: blockchain technology. By anchoring real, physical items to digital information, you could use blockchain transactions to track everything from real estate deals to how a fish caught off the coast of Japan made its way to a sushi restaurant's menu. Using a digital record to track each stage of a transaction can help prevent problems ranging from fraud to food poisoning.

Blockchain technology requires an open network with many computers, making it nearly impossible to hack. Which computer would hackers even target? How could they know it would be the first to get the transaction data deciphered? Security in the digital realm seems shaky, but blockchains could be the answer.

Not so fast. While the blockchain might be impenetrable, bitcoin buyers do need a place to store their digital dollars. So "digital wallets" were developed as places to keep this currency, and digital wallets can be hacked, or even inadvertently erased. Many third-party companies that promised to protect and store users' bitcoins simply disappeared, and with no oversight from any government, there's no recourse to get that digital currency back.

And as the volatility in value proves, it's hard to have a lot of faith in a bitcoin from day to day, which is the cornerstone of a currency's success. More and more people are treating bitcoin as an investment vehicle like a stock or bond than a currency.

However, the more people and businesses that do use it as currency, the more stable the value becomes, making it a true contender for the currency of tomorrow. For more details on all of the fundamentals of cryptocurrencies, listen in to the entire part one episode. Then click here for part two of the series as Stuff They Don't Want You To Know goes even further down the bitcoin rabbit hole.

Advertisement