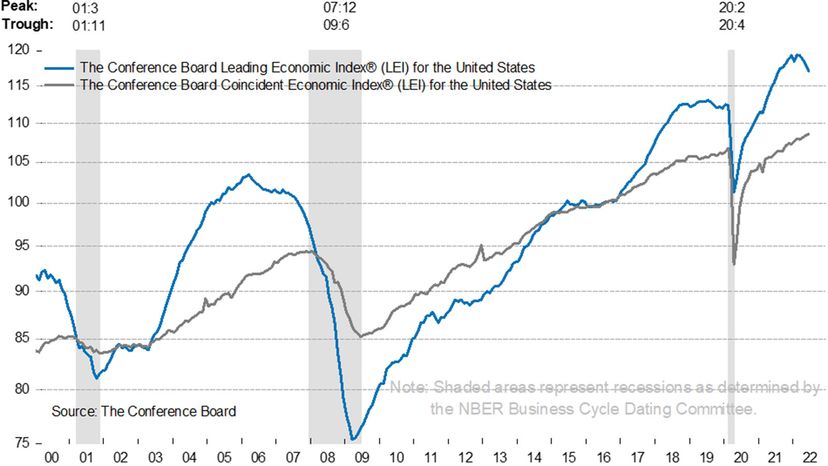

The past 50 years have taught us that every heady economic high must have a soul-searching low, and recent history bears that out.

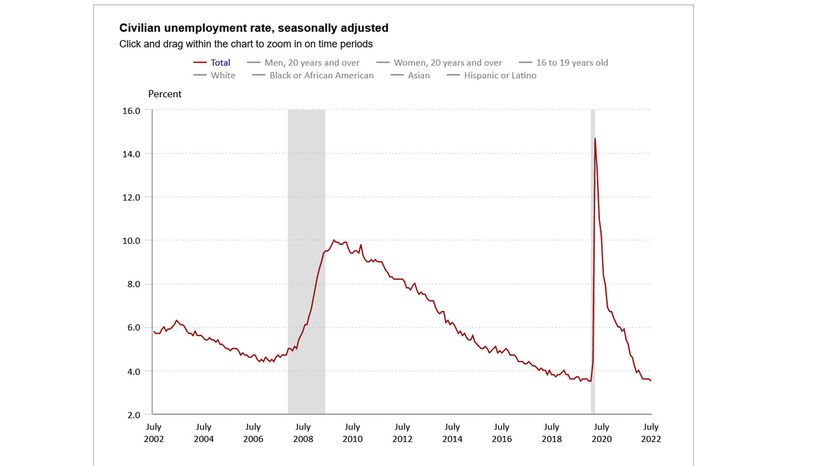

The Great Recession of 2007 to 2009 was the worst financial crisis in the United States since the Great Depression of the 1930s. The fallout from the Great Recession included the collapse of the housing market, major banks on the brink of failure, steep stock market losses, withered up retirement portfolios and double-digit unemployment.

Advertisement

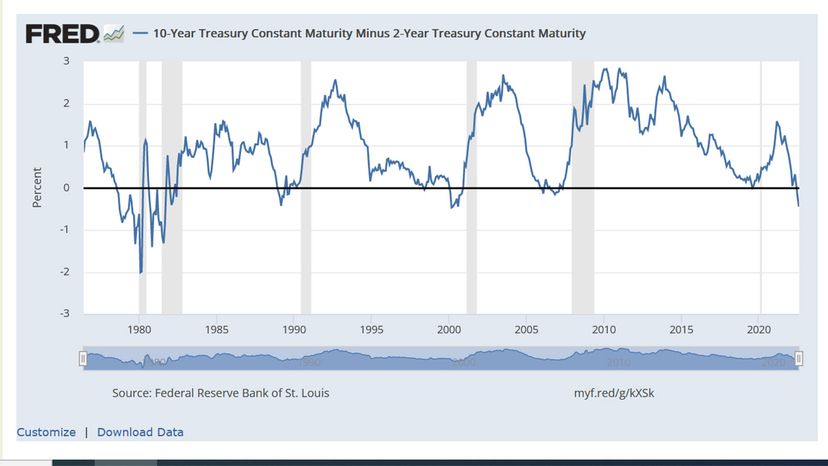

But the economy eventually recovered and recorded a decade of steady growth before the coronavirus outbreak nearly sank the stock market in March and April 2020 and sent the unemployment rate soaring. Now, in 2022, unemployment is low again, but concerns about high inflation and rising interest rates have some economists once again forecasting a recession on the horizon.

If you're trying to predict the economic future — good luck, even "experts" routinely get it wrong — it's time to familiarize yourself with the clearest warning signs of a looming recession. Here are seven.