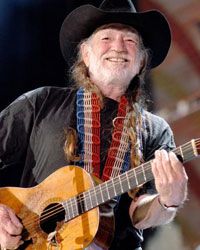

Tax evasion challenges the idea that any publicity is good publicity. Sure, an IRS indictment is a quick way for a celebrity face to get splashed across media outlets from the Enquirer to the New York Times, but with more than a 90 percent conviction rate [source: IRS], when the taxman takes a celeb to trial, that celeb might as well say goodbye to the home, the car, the private jet -- it's like a county song. (Just ask Willie Nelson.)

"Actually, the reasons celebrities get in trouble with the IRS are the same reasons you and I get in trouble," says Brian Compton, president of the company Tax Resolution Services. "They fail to file returns, or they file returns that are significantly false." But the reason celebs get prosecuted may be a bit different. "The IRS loves to make examples of celebrities, putting their heads on the proverbial pike as a warning to the rest of us: Pay your taxes!" says "Tax Lady" Roni Deutch, expert in celebrity tax troubles.

Advertisement

But no matter the reason, this death of a thousand paper cuts comes in three flavors: the oblivious (Nic Cage: I'm just an entertainer!), the nefarious (Heidi Fleiss: What extra income?) and the couldn't-prove-anything-else (Al Capone: Really? Tax evasion?). And the resolution comes in two flavors: civil and criminal.

Criminal is easy (and relatively rare) -- the celeb goes to jail. But if celebs can't pay back taxes in a civil case through bank accounts or liquidating assets, resolution can get creative. The IRS took a percentage of the gate of Mike Tyson's prizefights. Willie Nelson went on a pay-the-taxman tour. And Wesley Snipes' acting fees went straight to the government until his debt was paid.

But you ain't seen nothing yet! Following is a list of some of the most famous celebrity tax evaders.