Would you like to put money aside and earn significant interest returns in only a few weeks or months? You might consider buying Treasury bills, a popular and accessible form of investment. You don't have to be rich to afford them, and they are simple and virtually risk-free.

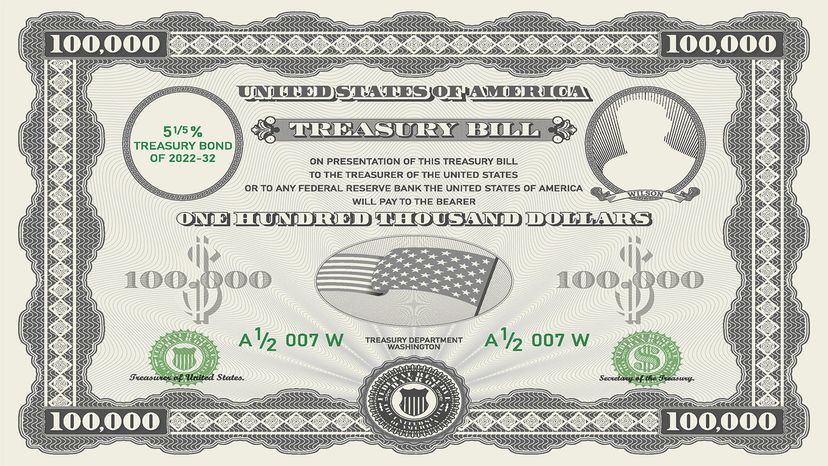

Treasury bills, also known as "T-bills," are a short-term security issued by the U.S. government. When you buy one, you are essentially lending money to the government. Here, the term "security" means any medium used for investment, such as bills, stocks or bonds.

Advertisement

Treasury bills have a face value of a certain amount, which is what they are actually worth. But they are sold for less. For example, a bill may be worth $10,000, but you would buy it for $9,600. Every bill has a specified "maturity" date, which is when you receive money back. The government then pays you the full price of the bill — in this case $10,000 — and you earn $400 from your investment.

The amount that you earn is considered interest, or your payment for the loan of your money. The difference between the value of the bill and the amount you pay for it is called the "discount rate," and is set as a percentage. In the example above, the discount rate is 4 percent, because $400 is 4 percent of $10,000.

Treasury bills are one of the safest forms of investment in the world because they are backed by the U.S. government. They are considered risk-free. They are also used by many other governments throughout the world.

Read on to find out about the different kinds of Treasury bills, how to buy a Treasury bill and why they are so popular.

Advertisement