So, you got a little forgetful and left your day planner with tickets to a baseball game and $200 cash on the roof of your car. And that day planner just happened to fall off at a railroad crossing.

Everything got mangled when the 4:05 freight train went barreling through the crossing. The baseball tickets are gone, the planner is a lost cause and all that's left of the cash is a chewed up $20. You can't possibly use it can you? Or can you?

Advertisement

Actually, most damaged U.S. cash — whether it's shredded by a train, damaged in a flood or even if your dog eats it — the U.S. Department of Treasury's Bureau of Engraving and Printing (BEP) has you covered through its Mutilated Currency Redemption Service.

But it takes a lot for a bank note to be considered "mutilated." Bills that are dirty, limp, defaced, torn or "clearly more than one-half the original note" don't go far enough. The BEP defines mutilated currency as bills that have been "severely damaged — to the extent that its value is questionable or security features are missing."

That means if the $20 bill from our railroad example is simply torn it's no problem. Get out the tape and spend away.

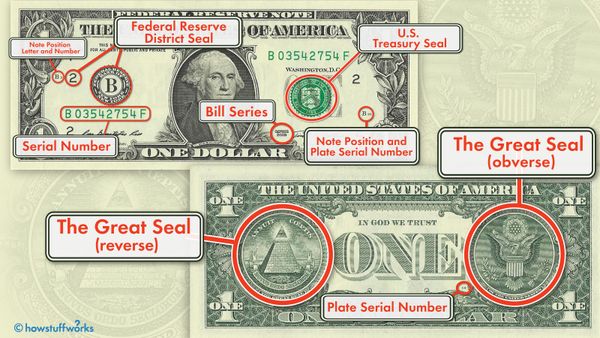

But, let's say you find a cache of cash buried in your yard (I mean, this happens all the time, right?). The bills have deteriorated to the point that security features such as watermarks, color-shifting ink, security thread or 3D security ribbon are no longer visible or destroyed. Now things are a little more complicated.

In cases like this (again, this happens all the time, right?), you'd have to submit what's called a mutilated currency claim to the BEP. It's basically a letter describing how the currency got damaged. You'd include its estimated value and other contact information, including your banking information.

You'd also need to send the money to the BEP where they'll exam it. This process can take anywhere from six months to three years depending on how complicated the case and how damaged the currency.

The Treasury Department has guidelines on its website about how you'd package up the cash for shipping. But in general, you need to send it in the exact same condition you found it. If the currency was flat, keep it that way; if it was in a roll, don't try to straighten it. (One caveat: Defaced coins shouldn't be sent with currency. They go to the U.S. Mint for evaluation and aren't redeemable for cash value; only the value of the metal.)

So how much can you get back for your damaged cash? That depends on what the BEP examiner finds.

Treasury Department regulations state that U.S. currency can be exchanged for full value if more than 50 percent of the bill is identifiable as U.S. currency, and enough of any relevant security features remain. OR if 50 percent or less of a bill is present and Treasury examiners are convinced that the missing portions have been destroyed. Basically, that means, you should receive the full amount if what you've turned in is recognizable as cold, hard American cash.

Advertisement