The most common type of bank account, and probably the first account you'll ever have (after a checking account), is a savings account. Savings accounts allow you to keep your money in a safe place while it earns a small amount of interest each month. These accounts usually require either a low minimum balance, like $25, or may require no minimum balance at all. This depends on the bank and the type of account.

Besides the fact that you will be less likely to spend it, putting your money in a savings account is safer because it is insured. If your home is robbed or burns down, your money may be lost forever. Banks and credit unions, on the other hand, keep your money in a locked and fireproof safe. Banks insure your money (up to $100,000) through the Federal Deposit Insurance Corporation (FDIC). This means that even if the bank goes out of business (which is very rare!) your money will still be there. (The National Credit Union Administration (NCUA) insures credit union accounts up to $250,000.) The FDIC is an independent agency of the federal government that was created in 1933 because thousands of banks had failed in the 1920s and early 1930s. Not a single person has lost money in a bank or credit union that was insured by the FDIC since it began. When you put your money into a savings account, it earns interest. Interest is money the bank pays you so that they can use your money to fund loans for other people. That doesn't mean you can't have your money whenever you want it, though. That's just how banks make money -- by selling money! Basically, it works like this:

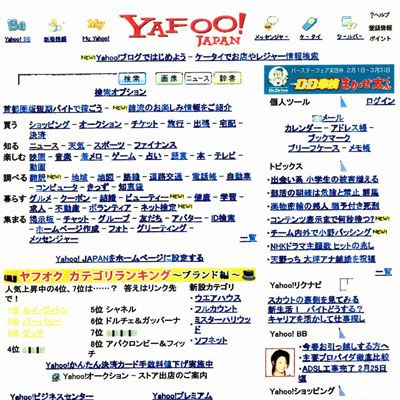

Advertisement

- You open a savings account at the bank.

- The bank pays you interest on the money that you deposit and leave in that account.

- The bank then loans that money out to other people, only they charge a slightly higher interest rate on the loan than what they pay you for your account.

The difference in interest they pay you verses the interest they charge others is part of how they stay in business.

Interest on savings accounts is usually compounded daily and paid monthly. The cool thing about compounded interest is that the bank is paying you interest on the money they've paid you in interest! That means that if your account earns one percent interest, then each day 1/365th of that one percent of the amount of money you have in your savings account is then added to your total. Here is the calculation:

On the next page, we'll explore how banks and credit unions manage savings accounts and explain what happens when you open your new account.

Advertisement