Forget about getting a driver's license, growing hair in strange places or moving out of your parents' home. The first real sign that you're well on your way to becoming a full-fledged "adult" is filing a tax return. That's right, with the ability to earn great, modest or even mediocre sums of money comes the equal responsibility of making sure that Uncle Sam gets his piece of the pie. Sure, the American Dream is all about building a little nest egg for you and your family. Just be certain that you put a little bit to the side each year for when the tax man comes calling.

Fret not, first-time tax-filers. The good news is that, if you work in a traditional employment setting, your employer has probably done some of the heavy lifting for you. Businesses and other employers typically withhold a certain portion of their workers' paychecks to cover estimated taxes. If you filled out a W-4 when you started working, then you've probably been getting taxes withheld over the course of the year. The best way to find out is by looking at a recent pay stub, which will indicate the amount of money taken out for tax purposes.

Advertisement

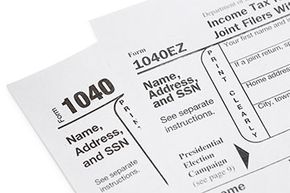

At the end of the year, your employer will send you a W-2 detailing how much you made in wages and tips and how much was withheld. All you have to do is fill out some basic paperwork using this information and explaining whether you're entitled to a variety of credits and deductions. That should give you an idea of how much you still owe the government or – if you're lucky – how much the authorities owe you [source: IRS].