Every worker remembers his or her first payday. Whether the check was big or small, there was a deep satisfaction in tearing open the envelope and seeing that dollar sign. Over the years, the checks may arrive with less fanfare, but always with a strong sense of pride. This is the nature of work; fair and timely compensation for a job well done.

Payroll, at its most basic, is the process by which an employer pays an employee for work performed. If you own your own business, but don't have any employees, then you don't have to worry about payroll. But as soon as you hire your first worker, you have a responsibility to pay that employee on time and the correct amount.

Advertisement

If employers fail in their payroll duties, their workers will be less motivated to fulfill their end of the bargain. They'll be less productive and suffer from low morale. And if you make a mistake on an employee's paycheck enough times, he'll probably quit.

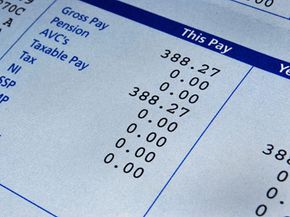

From the worker's perspective, payroll seems like a simple task. But there's more to it than just signing a check and delivering it to your desk. An employer must make sure that the proper taxes are withheld from each paycheck and that those funds are paid to the right government agency at the right time. Complicated tax forms must be filled out and filed on an annually, quarterly, sometimes even weekly basis. Missed deadlines and improper tax filings can result in steep fines and even jail time.

Payroll duties can be a real burden on a small business owner. Instead of focusing on product development, customer service and other important business tasks, the boss is stuck in the back with a calculator and a stack of IRS forms. That's why all businesses, and especially small businesses without their own accountants, need a reliable, effective and easy-to-use payroll system.

Sure, it's possible to handle payroll responsibilities with a pen, ledger sheet and calculator, but nowadays most business owners use either an outsourced payroll service or computerized payroll software.

What are the features and functions of a good payroll system? What are the advantages and disadvantages of computer software versus a full-service payroll provider? And how do you choose the best system for your business? Keep reading to find out.

Advertisement