401(k) retirement accounts allow employees to save for, well, retirement. In a tax-deferred 401(k), workers contribute a percentage of their pre-tax dollars into the account. The money they contribute lowers their taxable income so they pay less in taxes. A person can also save money by not paying taxes on the earnings of your account.

Sounds great, right? There's a catch. You will ultimately have to pay taxes on the money that you withdraw. However, when you retire, your income will probably drop. That will put you in a lower tax bracket. As a result, when you start withdrawing money from your tax-deferred 401(k), you'll be taxed at a much lower rate than what you paid when you were working [sources: TurboTax, CNN].

Advertisement

You can also lower your tax bill by deducting your contributions to your 401(k), based on your filing status and income level. It's called the saver's credit, or retirement savings contributions credit. The government kept the income ceilings for this credit very low so those with low incomes can put money aside for retirement [source: IRS]. The income limits are:

- $27,750 for people who are single, widowed or married but filing separately

- $41,625 for a head of a household

- $55,500 for couples married and filing joint returns

The amount of the credit generally ranges from $1,000 to $2,000 each year. You're eligible for the credit if you're 18 years old or older, not a full-time student and not claimed as a dependent on someone else's tax return. The amount of the credit you are eligible to receive can be 50 percent, 20 percent or 10 percent of your 401(k) plan contributions, up to $2,000 or $4,000 if you're married and filing joint returns [source: IRS].

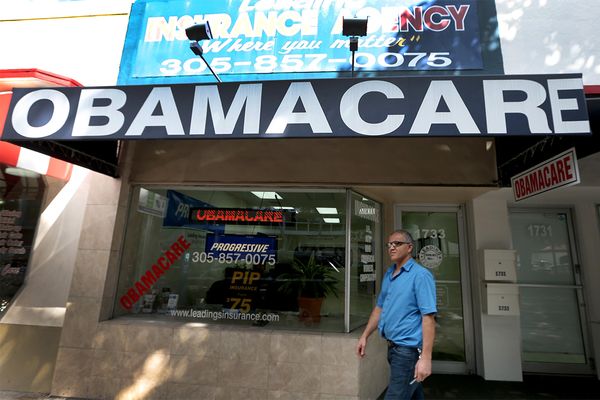

A Roth 401(k) is a different story. When you contribute to your Roth account, it has no impact on your taxable income. That's because you are using after-tax dollars to contribute to the account. However, you won't have to pay taxes when you become eligible to withdraw money from your Roth IRA [source: IRS].

Advertisement