Legend has it that Joseph Kennedy sold all the stock he owned the day before "Black Thursday," the start of the catastrophic 1929 stock market crash. Many investors suffered enormous losses in the crash, which became one of the hallmarks of the Great Depression.

What made Kennedy sell? According to the story, he got a stock tip from a shoeshine boy. In the 1920s, the stock market was the realm of the rich and powerful. Kennedy thought that if a shoeshine boy could own stock, something must have gone terribly wrong.

Advertisement

Now, plenty of "common" people own stock. Online trading has given anyone who has a computer, enough money to open an account and a reasonably good financial history the ability to invest in the market. You don't have to have a personal broker or a disposable fortune to do it, and most analysts agree that average people trading stock is no longer a sign of impending doom.

The market has become more accessible, but that doesn't mean you should take online trading lightly. In this article, we'll look at the different types of online trading accounts, as well as how to choose an online brokerage, make trades and protect yourself from fraud.

Review of Stocks & Markets

Before we look at the world of online trading, let's take a quick look at the basics of the stock market. If you've already read How Stocks and the Stock Market Work, you can go on to the next section.

A share of stock is basically a tiny piece of a corporation. Shareholders -- people who buy stock -- are investing in the future of a company for as long as they own their shares. The price of a share varies according to economic conditions, the performance of the company and investors' attitudes. The first time a company offers its stock for public sale is called an initial public offering (IPO), also known as "going public."

When a business makes a profit, it can share that money with its stockholders by issuing a dividend. A business can also save its profit or re-invest it by making improvements to the business or hiring new people. Stocks that issue frequent dividends are income stocks. Stocks in companies that re-invest their profits are growth stocks.

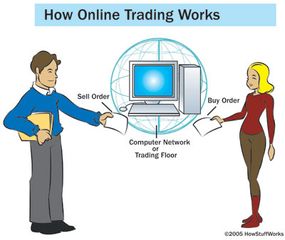

Brokers buy and sell stocks through an exchange, charging a commission to do so. A broker is simply a person who is licensed to trade stocks through the exchange. A broker can be on the trading floor or can make trades by phone or electronically.

An exchange is like a warehouse in which people buy and sell stocks. A person or computer must match each buy order to a sell order, and vice versa. Some exchanges work like auctions on an actual trading floor, and others match buyers to sellers electronically. Some examples of major stock exchanges are:

- The New York Stock Exchange, which trades stocks auction-style on a trading floor

- The NASDAQ, an electronic stock exchange

- The Tokyo Stock Exchange, a Japanese stock exchange

Worldwide Stock Exchanges has a list of major exchanges. Over-the-counter (OTC) stocks are not listed on a major exchange, and you can look up information on them at the OTC Bulletin Board or PinkSheets.

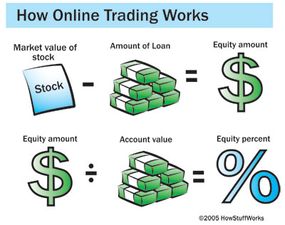

When you buy and sell stocks online, you're using an online broker that largely takes the place of a human broker. You still use real money, but instead of talking to someone about investments, you decide which stocks to buy and sell, and you request your trades yourself. Some online brokerages offer advice from live brokers and broker-assisted trades as part of their service.

If you need a broker to help you with your trades, you'll need to choose a firm that offers that service. We'll look at other qualities to look for in an online brokerage next.

Advertisement