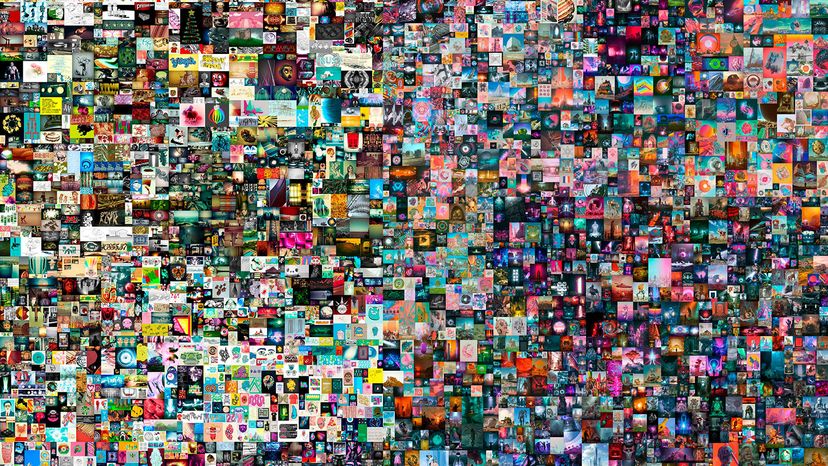

In March 2021, the auction house Christie's sold a work of art titled "Everydays: The First 5000 Days" by an artist known as Beeple for $69,346,250.00. It was an intriguing event for several reasons. The price of "Everydays" was the third-highest price ever for a work by a living artist, and the highest paid for art that only existed in digital form as a JPG file, according to The New York Times. The artwork, a collection of all the images Beeple had been posting online since 2007, sold for more than physical masterworks from painters like J.M.W. Turner and Francisco Goya had when they were auctioned.

Beyond that, the ownership of "Everydays" changed hands via a non-fungible token, or NFT, a cutting-edge type of commerce that might transform the world of art and collectibles. ("Non-fungible" means the item can't be replaced with an equivalent. It's one of a kind.) An NFT is a digital asset — a sort of electronic representation of value, like bitcoin or some other digital currency. But unlike a bitcoin, which is identical to any other bitcoin in the way that a dollar bill is the same as any other dollar bill (i.e., "fungible"), an NFT is linked — "minted," in techno-lingo — to some unique object.

Advertisement

An NFT could be linked to a digital painting, or to a $580,000 meme of an animated flying cat, or to a video clip of Los Angeles Lakers superstar forward LeBron James throwing down a spectacular dunk, which has been sold for more than $200,000. The rock group Kings of Leon even offered a special collector edition of its new album as an NFT, Variety reported. It's possible to buy an NFT-minted digital house that can be uploaded to and experienced in a 3-D virtual reality-augmented-reality environment online. Heck, even a robot sold a piece of digital artwork it had done for $700,000.

"Historically, tokens have been used for a wide range of things including subway rides to use of arcades," explains Mark Williams via email. He's an executive-in-residence/master lecturer in finance at Boston University's Questrom School of Business, whose expertise includes virtual currencies and blockchain. "The modern speculative version of this is NFTs."

Instead of hanging in an art gallery or being stored in a freeport, NFT-minted digital art resides on a computer server someplace, while the NFTs linked to it are stored in a blockchain, a decentralized digital database on which transactions are recorded on scores of computers at once. (Here's online digital money, payment and applications platform Ethereum's explainer on how NFTs work.)

"An NFT is a digital authentication, showing provenance of who created the object and its history of ownership," Williams explains. "These tokens are designed to operate on the blockchain and when traded, allowing digital ownership to be securely recorded on-chain."

The collector who owns the digital artwork still can show it to other people, the way that an owner of rare art might take a smartphone picture of the Picasso sketch hanging in the den and send it to a friend. "Off-chain activities by a non-buyer such as reproducing, sharing and/or displaying the digital art is not controlled or prevented," Williams says. He explains that the value of digital art linked to an NFT "has less to do with scarcity and more to do with perceived value of owning a certificate of authenticity. The other part of the value is pure speculation that someone in the future will pay more for the NFT than it is worth today."

Even though the purchaser of an NFT could pay with cryptocurrency and mask his or her identity, in some ways, the use of blockchain ledgers and digital authentication actually might bring a greater degree of transparency to the art world.

"In the past the price for a collectible item was Price = Value minus Concern over Authenticity," Jay Zagorsky writes in an email. He's another senior lecturer in markets, public policy and law at Boston University's Questrom School. "There are numerous stories of paintings going for almost nothing and then being authenticated and soaring in value. There was a work by da Vinci that sold in 2005 for less than $10,000 and is now worth at least $450 million. Using blockchain technology changes the equation to Price = Value, since there is no concern over authenticity."

But is there a concern about using cryptocurrency to buy a collectible item? Not necessarily. "In the collectible world, many items are bought and sold at auction and the seller/buyer is never identified to reduce the chance of theft after the auction is over. People don't want to be known as the person with the famous item in [their] house because thieves might target them," Zagorsky says.

Advertisement