Very few of us work for free. But not everyone gets paid in the same way. You might be paid hourly, on a salary, by commission or work mostly for tips. Many different federal and state laws govern how much people can be paid and when. These laws also dictate how much we have to pay for taxes and whether certain jobs, like ones that require overtime or dangerous work, should pay more.

In this article, we’ll explore all aspects of wages -- from the legal side, to the types of wages, to taxes, to how much money you’ll finally take home. Because there are so many different state laws concerning wages, we’ll focus mainly on federal law. It’s always a good idea to check with a labor lawyer or your state’s Department of Labor to learn more about laws that may apply to your state.

Advertisement

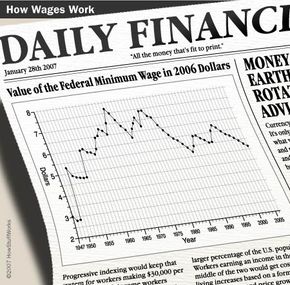

The Fair Labor Standards Act (FLSA) is the most important law covering wages. Originally passed in 1938 but amended many times since, the FLSA sets standards for minimum wage and overtime pay, affecting most private and public employees. A nice feature of this law is that wherever it may overlap with state law, the law dictating higher standards is obeyed. This feature has become especially important with minimum wage, allowing individual states, cities and counties to pass their own minimum wages laws that are higher than the federal minimum wage.

The Act applies to all employees involved in interstate commerce, a definition that is generally very broad -- a business that receives telephone calls or mail from other states may be deemed to be engaging in interstate commerce. Firms that do more than $500,000 in business annually are usually covered under the act, and the following businesses are covered no matter their volume of business:

- Government agencies

- Hospitals

- Institutions that take care of the sick, elderly or disabled

- Schools

Domestic service workers are covered if they earn at least $1,400 in wages from an employer in a year or if they work more than eight hours a week. To figure out if you’re exempt from the FLSA, contact your local Wage and Hour Division Office or check out the Department of Labor’s Employment Law Guide.

Next, we'll look at minimum wage and other provisions of the Fair Labor Standards Act.

Advertisement