The U.S. Social Security system has been in the news a lot lately. While politicians throw around dramatic words like "crisis" and "bankrupt," regular Americans have more mundane concerns. How will they pay their bills when they retire? What happens if they are disabled and unable to provide for their families?

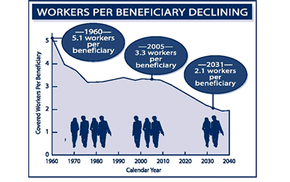

Social Security is a system that attempts to address all these issues and more. From its roots in the Great Depression, Social Security has changed with the times to try and help poor, out-of-work, disabled and elderly Americans. Whether the system is truly in crisis or not, it will surely have to change in the coming decades as the number of retirees increases relative to the number of workers.

Advertisement

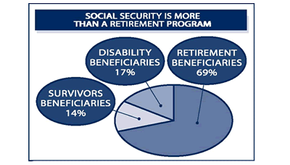

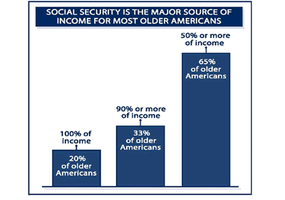

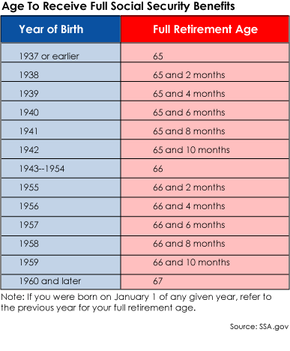

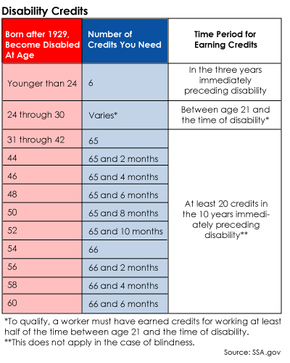

Social Security is a far-reaching system, offering many types of benefits. In this article, we'll focus on the retirement- and disability-benefit aspects of the Social Security system. We'll find out how Social Security got started, how it works today and what might happen in the future if we don't make some changes.

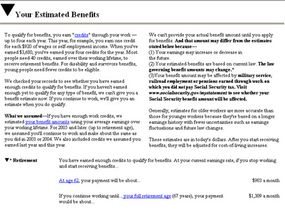

Most Americans are covered by some form of Social Security. Exceptions include some government employees and railroad workers, who are covered by other programs, and certain agricultural and domestic workers. But chances are, if you are a U.S. citizen and you work in the United States, you receive a statement in the mail every year that looks something like this:

If you receive this statement, it means that you are paying a certain percentage of your salary into the Social Security system -- and the idea is that you will get this money back once you retire so you have some extra money to live on once you stop receiving your paycheck.

In the next section, we'll look at the different types of Social Security benefits.

Advertisement