There's absolutely no reason to spend money on a credit report. In addition to AnnualCreditReport.com, several companies offer free credit reports and even free credit scores without having to enter any credit card information. Even though they're free, there are some pros and cons to consider.

Credit Karma is probably the best-known of these free credit-monitoring companies. If you sign up with Credit Karma, it will send you free credit reports from TransUnion and Equifax, plus weekly updates of activity on either report.

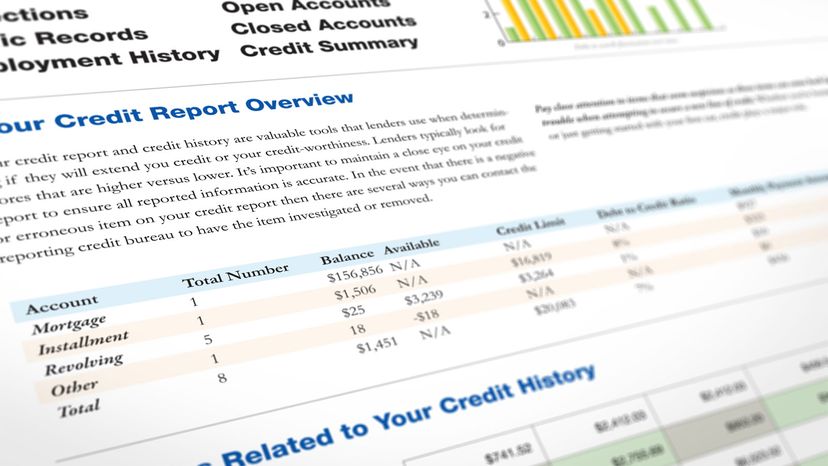

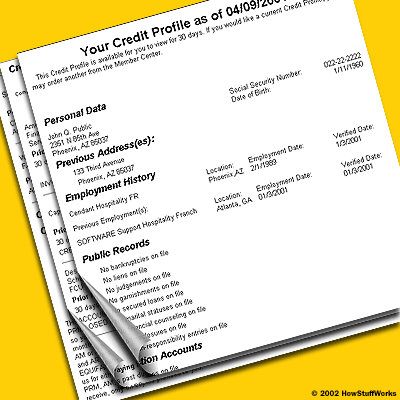

Credit Karma will also provide you with a free credit score from TransUnion and Equifax. Your credit score is a three-digit number calculated using information on your credit report, like how many open credit accounts you have and how many late payments you've made. Lenders use both the shorthand credit score and fuller credit reports when making loan decisions, so it's useful to know your score — and sites like myFICO will charge you $20 for it.

What are the downsides of Credit Karma? For one thing, you don't get access to a credit report from Experian, but you can still get that once a year via AnnualCreditReport.com. And while Credit Karma won't charge you a dime for its credit-monitoring services, it's not a charity. The company makes money by advertising credit card and loan offers. If you sign up with one of those credit cards or get a car loan through one of the suggest lenders, Credit Karma charges a fee to the bank or other lender.

Basically, by signing up with Credit Karma, you're giving them permission to use your credit and spending data to send you emails and serve you ads. It's not that different from Google or Amazon using your browsing and shopping history to show you targeted online ads, but some people would rather keep their financial information 100-percent private.