Blown away by your monthly debt payments? Debt can be frustrating and scary, but there are ways to deal with it. And it helps to remember that you're not the first person in over his head...

Advertisement

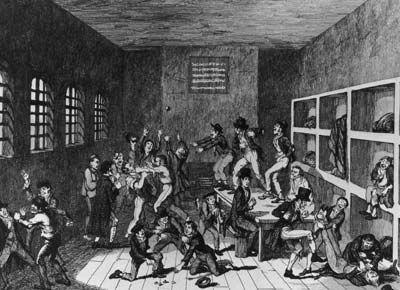

The Wood Street Compter prison in London, circa 1660. Imprisonment was a common (and rather pointless) way governments dealt with debtors, who were given no way to earn money to pay back their debts. See a modern image of debt next.

This is often how it starts. A few impulse purchases on a credit card lead to increased minimum payments, and before long you're in over your head. So where can you turn?

Pawning your stuff may net you some quick cash, but it's no long-term solution. See a better idea next.

If you're deep in debt, or you don't ever want to be, you should get rid of your credit cards to stop the debt spiral. And then what?

Advertisement

The easiest way to get out of (and avoid) debt is to budget. Calculate your fixed expenses and see what you can truly afford for discretionary expenses.

Using cash instead of credit or debit cards can make it easier to control your spending. To stick to your budget, only take out as much as you can afford. And make it last until your next paycheck. Next, see what not to do when dealing with debt.

Debt consolidation can be very risky, so make sure you get all the facts if you want to try it. Next, see debtors take to the streets.

June 2, 2007, Taipei: Consumers with credit card debt, referred to as 'credit card slaves', urge the government to pass a law to help people owing money to banks. Debt is not just an individual problem. Check out the US's national debt next.

The National Debt Clock in Midtown Manhattan shows the total US government debt and the calculated amount per family. To learn more, read How Debt Works.

Advertisement