How did all of this get started? In the very early days, when people bought things on credit at the general store, the store clerk wrote the purchase amount on a piece of paper that was then put into a "cuff." A cuff was a paper tube that they wore on their wrist.

Eventually, someone had the idea of collecting all of the information from these clerks' cuffs and putting it together for other merchants to refer to before granting credit. The problem was, they only collected the bad information. The data also included character references, employment information, insurance information, and even driving records. There was no verification that the information was correct, and the customer had no way of knowing where it was coming from. The only groups that could access the information were lenders and merchants. These were known as mutual protection societies and roundtables, and their scope was limited geographically. This soon proved to be an inefficient way for businesses to protect themselves from bad debt.

In the 1830s, the first third-party credit reporting agencies were established. They were one of the first businesses that were national in scope, and actually functioned much like a modern-day franchise. They were set up as a network of offices across the country.

They differed from "mutual protection societies" in that they allowed anyone to access the credit information -- for a price. These "branches" paid a percentage of their profits to their CRA central office in exchange for credit information from other locations. When the typewriter and carbon paper were developed in the 1870s, they discovered even greater efficiencies. The information that was accumulated was more widely available, more accurate, and covered a much larger geographical area.

These new CRAs had to deal effectively with four groups: their subscribers, the consumers and businesses about whom they reported, their branch office correspondents, and the general public. Learning to work effectively with and keep these groups happy, as well as competing with other CRAs, helped form the agencies we know today.

Information that makes up your credit report includes:

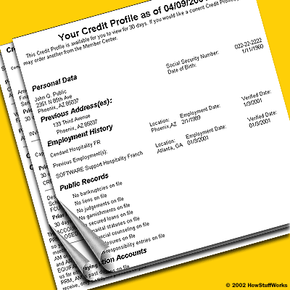

- Personal identifying information - This includes your name, address (current and previous), social security number, telephone number, birth date, your current and previous employers, and (on the version you get) your spouse's name may be included as well.

- Credit history - This section includes your bill-paying history with banks, retail stores, finance companies, mortgage companies, and others who have granted you credit. It includes information about each account you have, such as when it was opened, what type of account it is, how much credit it includes (or the amount of the loan), what your monthly payment is, etc. If you've closed the account or the loan has been paid off, then that information shows up as well. If there were missed or late payments, this is where that appears.

- Public records - Information that might indicate your credit worthiness, such as tax liens, court judgments and bankruptcies. This information is readily available from public records.

- Report inquiries - This section includes all credit granters who have received a copy of your credit report. It also includes any others who were authorized to view it. In addition, lists of companies that have received your name and address in order to offer you credit are included. These companies don't actually see your report, but get your name if you meet their criteria for an offer of credit, insurance or other product. This is where all of those "pre-approved" credit card offers come from.

- Dispute statements - The report may also include any statements you've made disputing information on the report. Most credit bureaus allow both the consumer and the creditor to make statements to report what happened if there is a dispute about something on the report.

Things that don't appear on most credit reports include:

- Bank account balances

- Race

- Religion

- Health (although medical bills may show up as debts)

- Criminal records

- Income

- Driving records

There are different versions of credit reports available depending upon the requestor. The consumer version includes all of the above information, as well as a listing of all inquiries for the report. The business version includes all of the above information, but only the inquiries made by companies with a "permissible purpose" -- this usually means someone with whom you have initiated business.

You've probably heard about a credit score as well. Don't confuse your credit score with your credit report. Credit scores are based on formulas that use the information in your report, but they are not a part of your report. Fair, Isaac and Company came up with a proprietary scoring formula that most creditors use, although there are other scoring methods that are used for various purposes. This score essentially boils down all of the information in your credit report to a single three-digit number. This gives creditors an easier way of making decisions about your creditworthiness. These numbers range from 300 to 850, with the higher number indicating a better credit risk. Read How Credit Scores Work to get the full scoop on how much a single number can affect your life.

Next, we look at how credit bureaus get information.