Benefits of Electronic Payment

Electronic payment is very convenient for the consumer. In most cases, you only need to enter your account information -- such as your credit card number and shipping address -- once. The information is then stored in a database on the retailer's Web server. When you come back to the Web site, you just log in with your username and password. Completing a transaction is as simple as clicking your mouse: All you have to do is confirm your purchase and you're done.

Electronic payment lowers costs for businesses. The more payments they can process electronically, the less they spend on paper and postage. Offering electronic payment can also help businesses improve customer retention. A customer is more likely to return to the same e-commerce site where his or her information has already been entered and stored.

Advertisement

With all the benefits of electronic payment, it's no wonder that its use is on the rise. More than 12 billion ACH payments were made in 2004, a 20 percent increase from 2003 [ref]. The 2004 Federal Reserve Payments Study noted that from 2000 to 2003, electronic payments grew as payment by check declined, which suggests that electronic payments are replacing checks.

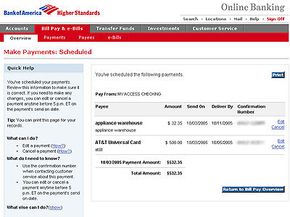

In order to better serve their customers, banks are swiftly moving to offer online bill pay services. Grant Thornton's 2005 survey of bank executives found that 65 percent of community banks and 94 percent of large banks offer 24/7 online bill payment [ref]. Most of these services are free to members and coordinate easily with personal software programs such as Quicken or MS Money. Alternatively, consumers can subscribe to online bill pay services such as Paytrust or Yahoo! Bill Pay. These services charge a monthly fee in exchange for the convenience of paperless bill paying.

In the next section we'll discuss the concerns that some people have about using electronic payment.