Whenever the economy begins to sag, it isn't long before serious investment advisors and doomsayers alike begin to throw the word "gold" around. Depending on who you ask, gold is either a wise way to diversify an investment portfolio or an insurance plan against the coming apocalypse. Historically, gold has been seen as a low-risk investment that can mitigate your losses when stocks and bonds begin to lose value, mainly because the price of gold tends to increase during bear markets and periods of inflation [source: Steel]. The common wisdom is that gold will never hit rock bottom, since it will always have some inherent value as a precious metal.

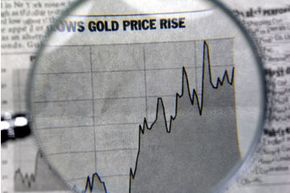

After the credit crisis in 2008 and the ensuing slumps in the stock market, the commodity price of gold began to climb. The metal posted record highs repeatedly over the next two years, reaching $1,432.50 per ounce in December 2010 [source: Dreibus]. Over the course of 2010, gold increased in price by 27 percent. By comparison, the rebounding stock market increased by only 11 percent that year [source: Steel]. Economists disagree about whether gold can possibly continue its meteoric rise in price. Some predict that the current high is a bubble set to burst, and that a huge selloff of gold will soon drive the price back down [source: Flood]. Others are sure gold still has another year or more of strong gains [source: Krauth]. Historically, the price of gold tends to be volatile, experiencing regular peaks and troughs as big-picture economic conditions change.

Advertisement

Whatever happens to gold, the metal is always a good long-term investment. Many financial advisors recommend investors keep about 5 percent of their portfolio in gold or gold-related securities, as a hedge against downturns in the market [source: Picerno]. But how does someone invest in gold? Is it as easy as walking to the jewelry store and stocking up? Read on to find out how to invest in every type of gold, from coins and bars to mining stocks and commodity futures.