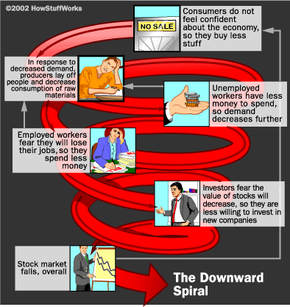

On Jan. 21, 2008, stock prices tumbled around the world. Most analysts pointed to fears surrounding the United States economy and a possible recession as the reason for the drop. Ironically, economic conditions in the United States were affecting the world economy on a day when its own markets weren't even in session -- they were closed for the Martin Luther King Jr. Day holiday. Three days later, news outlets were already reporting a new economic stimulus package, designed in part to try to prevent a recession.

This isn't the first recession news in recent memory. On Nov. 26, 2001, the news media announced the United States was officially in a recession and had been since March of that year. To most Americans, this wasn't all that surprising: Rising unemployment and a weak stock market had been in the news for months.

Advertisement

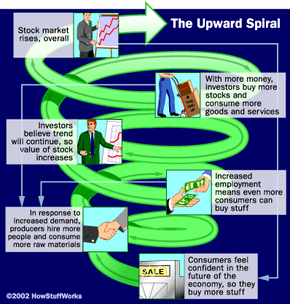

Both the 2008 market drop and the 2001 news blitz raised a lot of questions. Who decides when the economy is in recession, and on what grounds? What actually constitutes a recession, anyway? When a nation's economy enters a recession, is life guaranteed to get harder for most of its citizens? And how often does a recession lead to a depression?

In this article, we'll find out what recessions are, see why they occur and examine the criteria economists use to identify them. We'll also look at the effects of recession as well as explore some of the ways a country can turn the economy around again.

Advertisement