Takeovers are usually friendly affairs. Corporate executives engage in top-secret talks, with one company or group of investors making a bid for another business. After some negotiating, the companies engaged in the merger or acquisition announce a deal has been struck.

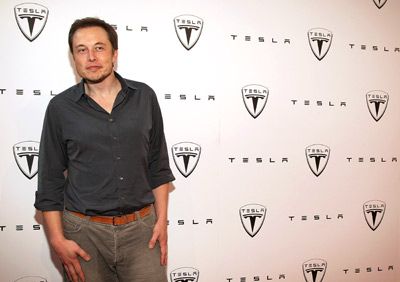

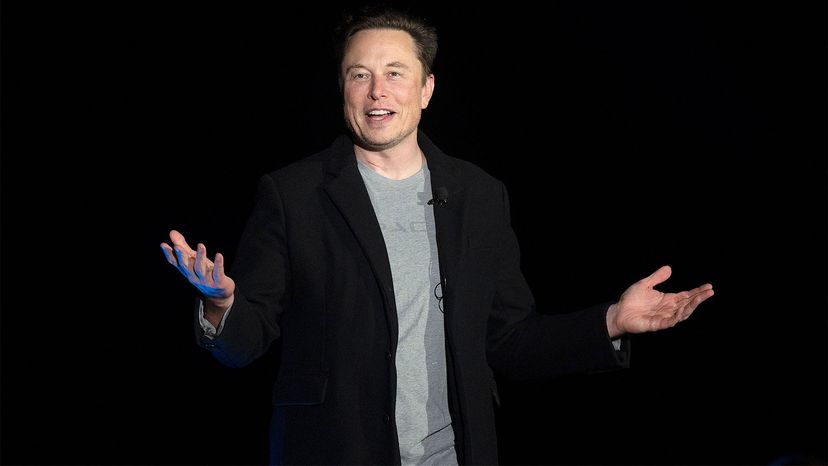

But other takeovers are more hostile in nature. Not every company wants to be taken over. This is the case with Elon Musk's $43 billion bid to buy Twitter.

Advertisement

Companies have various measures in their arsenal to ward off such unwanted advances. One of the most effective anti-takeover measures is the shareholder rights plan, also more aptly known as a "poison pill." It is designed to block an investor from accumulating a majority stake in a company.

Twitter adopted a poison pill plan April 15, 2022, shortly after Musk unveiled his takeover offer in a Securities and Exchange Commission (SEC) filing.

I'm a scholar of corporate finance. Let me explain why poison pills have been effective at warding off unsolicited offers, at least until now.

Advertisement