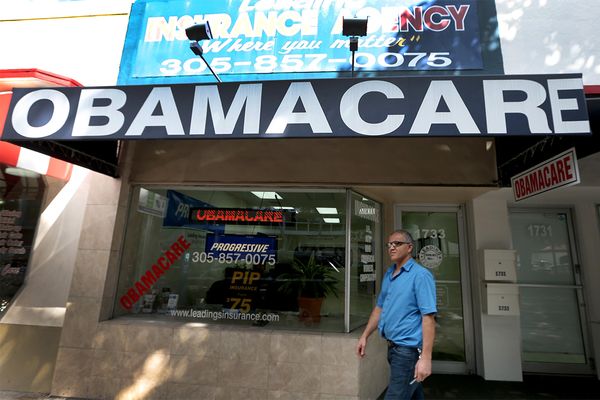

Health insurance is a safety net that many people can't afford to live without. But should American citizens actually be penalized for not buying health coverage? That's one of the most controversial provisions included in the Patient Protection and Affordable Care Act (ACA), signed into law by President Barack Obama in 2010.

The ACA is designed to expand health insurance coverage to a greater number of Americans:

Advertisement

- The bill allows young people to stay on their parents' insurance policy until they are 26 years old instead of 19.

- It improves health care options for people with pre-existing conditions, particularly children.

- And through a system of tax credits, it aims to make insurance premiums more affordable for lower-income families.

To help people find and purchase affordable health care coverage, the ACA called for the federal government — and individual states, if they wanted — to launch an online health insurancemarketplace.

But all of the benefits of the ACA come at a cost. For the system to work, healthy people must also sign up for health insurance. It's the only way for insurance companies to balance out the risk of taking on policies for people with pre-existing conditions. To achieve this balance, the ACA includes a controversial provision called the individual mandate.

The individual mandate requires all Americans — adults and children — to have "minimal essential coverage" or pay a penalty in the form of a tax. Health care coverage can come through an employer's health plan, a private insurance policy or through a government-sponsored program like Medicare, Medicaid, Children's Insurance Program (CHIP) or Veterans Affairs.

For the 2014 tax year, the penalty for not having health insurance coverage is the greater of two calculations [source: IRS]:

- 1 percent of your household income that is above the minimum threshold for your filing status; or

- $95 per adult in your family, plus $47.50 per child up to a maximum payment of $285

By tying the penalty to household income, the individual mandate provides a financial incentive for Americans who can afford health care coverage to buy it. But the law also recognizes that there are many people who simply can't afford health insurance (even with tax credits) or have other reasons — like religious objections — for not complying with the individual mandate. For those individuals and families, the ACA offers a number of financial, religious and hardship exemptions from the penalty.

Applying for an exemption to the individual mandate penalty isn't difficult, but you need to know which forms to fill out and what information you will need to gather beforehand. Keep reading to learn which exemptions require an application and which are automatic.

Advertisement