Fed Tasks: Monetary Policy

Monetary policy refers to the actions the Fed takes to influence financial conditions in order to achieve its goals.

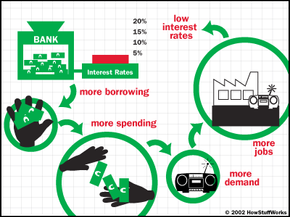

The Fed's primary control is in the raising and lowering of short-term interest rates. In doing this, the Fed can indirectly influence demand, which then influences the economy. For example, if interest rates are lowered, borrowing money to make purchases becomes less expensive, and people are more motivated to spend money because they can get a better deal on the loan. Spending money, in turn, stimulates economic growth, which is what the Fed is trying to do in that instance. If there is too much money in the economy, however, people spend more money and demand increases at a faster rate than supply can match. Prices rise too quickly because of the shortage of products, and inflation results. If there is too little money in the economy, people don't have excess spending money, and there is little economic growth.

Advertisement

The Fed watches economic indicators closely to determine in which the direction the economy is going. By forecasting increases in inflation or slow-downs in the economy, the Fed knows whether to increase or decrease the supply of money.

Influencing inflation takes a long time and has to be looked at as a long-term goal. Influencing employment and output, however, can be done more quickly and therefore is a short-term goal. Finding the balance between the two is key. The lags in the effects that monetary policy has on the economy are significant. This is why the Fed has to make forecasts of inflation prior to it actually happening -- one, two or even three years in advance. If the Fed waited until inflation were apparent, then it would be extremely difficult to catch up and get it back under control. We'll talk about the economic indicators shortly.